SEC Finalizes “Pay versus Performance” Disclosure Rules

By Samantha Nussbaum, Dina Bernstein

Share

On August 25th, the SEC adopted final rules implementing the pay versus performance disclosure requirement as required by the Dodd-Frank Act. This is one of the most significant SEC developments in the executive compensation arena in the last decade. Compliance in the first year will no doubt be a challenge for companies; especially around completely new requirements such as identifying the most important financial measures used to link pay and performance and calculating “actually paid” compensation. We will be following up with a more detailed analysis of the rules in the near term.

Proposed rules were initially issued by the SEC in 2015 (summarized here) and a comment period on the proposal was reopened in January of this year. The rules will be in effect for the Spring 2023 proxy season, or more specifically, companies must comply in proxy and information statements that are required to include Item 402 executive compensation disclosure for fiscal years ending on or after December 16, 2022.

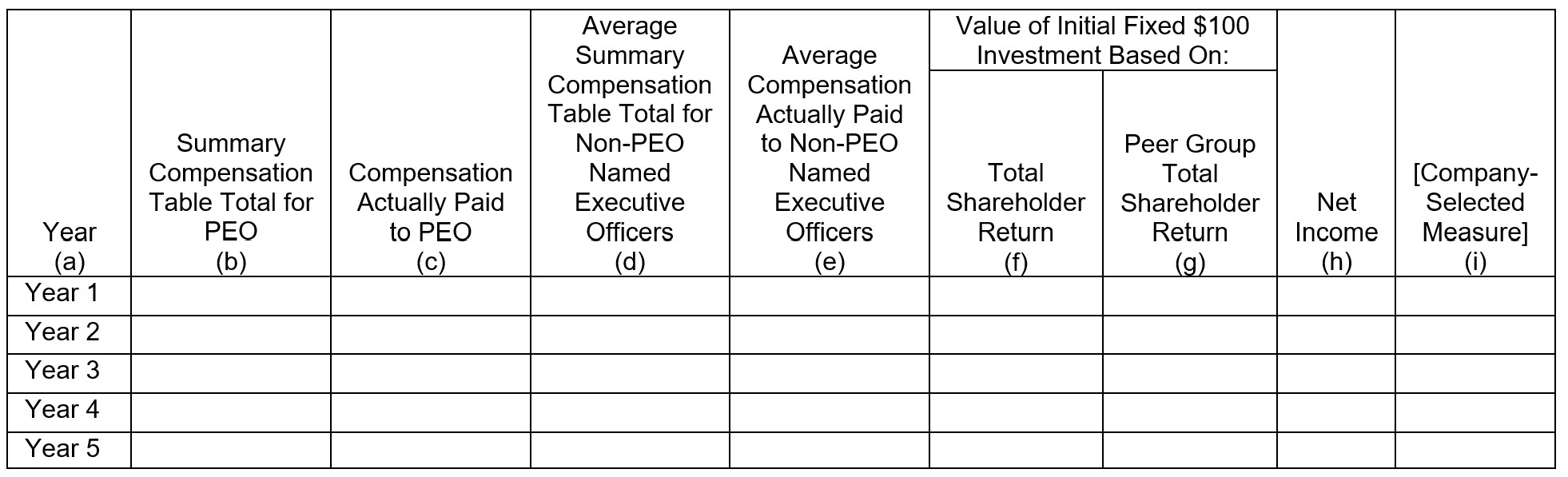

The new rules require tabular disclosure of specified executive compensation and financial performance measures for a company’s five most recently completed fiscal years. The table must include, for the principal executive officer (PEO) and, as an average, for the other named executive officers (NEOs), the total compensation as presented in the Summary Compensation Table and a measure of “executive compensation actually paid,” which is to be calculated as set forth in the rules.

The table is to include the following financial performance measures:

- The company’s total shareholder return (TSR);

- Indexed TSR for the company’s performance graph or executive compensation benchmarking peer group;

- The company’s net income; and

- A financial performance measure selected by and specific to the company (based on a company assessment to determine the most important financial performance measure it uses to link compensation actually paid to the NEOs to company performance for the most recently completed fiscal year).

The default tabular format provided under the new rules is as follows:

The final rules also require:

- A description of the relationships between TSR and each of the financial performance measures included in the table and the executive compensation actually paid to the PEO and NEOs over the five most recently completed fiscal years;

- A description of the relationship between the company’s TSR and that of its peer group; and

- A list of three to seven financial performance measures that the company believes are its most important measures for the most recently completed fiscal year (see approach above for the company-selected measure to use in the disclosure table), with an allowance for including non-financial measures as well.

The rules will apply to all reporting companies, except foreign private issuers, registered investment companies, and emerging growth companies. Registrants, other than smaller reporting companies (SRCs), will be required to provide the information for three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the two subsequent public filings that require the disclosure. Initially, SRCs will be required to provide the information for two years, adding one additional year of disclosure in the subsequent applicable filing.

The final rules will become effective 30 days following publication of the release in the Federal Register.

Samantha Nussbaum

Samantha Nussbaum

Principal

Samantha Nussbaum has consulted on behalf of public and private companies, compensation committees, and senior management on all aspects of executive compensation. Samantha’s consulting and legal background includes advising on executive compensation in the context of mergers and acquisitions, spin-offs, and initial public offerings; executive employment, severance, and change in control agreements; equity incentive plans; deferred compensation; and securities laws, including reporting and disclosure implications.

Dina Bernstein

Dina Bernstein

Principal

Dina Bernstein has extensive experience advising on all aspects of executive compensation, working with companies on an ongoing basis, as well as in the context of mergers and acquisitions, spin-offs, initial public offerings, and other corporate events. Dina provides guidance to private and public companies across various industries regarding cash and equity incentive compensation arrangements, employment, severance and change in control agreements, overall compensation program design, pay governance practices, taxation, stock exchange listing requirements and securities regulation compliance.