Alert

|

April 8, 2021

Update: Trends in 10-K Human Capital Resources Disclosures

By

David Gordon, Dina Bernstein, Andrew R. Lash

Share:

Read the full Alert below or download in pdf here.

New SEC rules, effective November 9, 2020, provide that annual reports must describe the registrant’s human capital resources (HCR) “to the extent material to an understanding of the registrant’s business taken as a whole.” FW Cook has now reviewed the first 50 10-K filings by large (market capitalization greater than $30B) calendar-year registrants (previously it had reviewed the first 50 filings by registrants with market capitalizations over $1 billion). This new review indicates:

- Disclosures are longer since the new rules initially went into effect, and

- Diversity and inclusion and employee training and development continue to be the most discussed topics.

Background

The SEC significantly revised the contents of Form 10-K, effective November 9, 2020. Like our Alert dated November 27, 2020 (link here), this Alert focuses on the portion of the new disclosure rules regarding HCR that require a registrant to discuss the following, “to the extent material to an understanding of the registrant’s business taken as a whole”:

“A description of the registrant’s human capital resources, including the number of persons employed by the registrant, and any human capital measures or objectives that the registrant focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the development, attraction, and retention of personnel).”

The new principles-based requirement leaves registrants with significant leeway in determining what to discuss with respect to HCR. To get a sense of disclosure trends, for our prior Alert we examined the first 50 10-Ks filed after the initial effective date by registrants with a market capitalization greater than $1 billion. We found significant differences in the approaches used.

For this Alert, we analyzed an additional sample of 50 disclosures, this time focusing on the first 50 filings for calendar-year registrants. These registrants had an opportunity to observe and learn from the initial filings that were made following effectiveness of the new requirements. Raising the market capitalization cut-off to greater than $30 billion generally captured registrants with larger employee populations and more developed human resources functions, which we expected would result in a more revealing set of HCR disclosures.

Our key findings are discussed below, following which we discuss three of the trends we observed: disclosures regarding diversity and inclusion (D&I), disclosures of tenure, promotion and turnover data, and the use of cross-references.

Key Findings

As noted above, the data in this Alert is based on the Form 10-K HCR disclosures of the first 50 calendar-year registrants to file that both (i) are part of the Standard & Poor’s 500 Index and (ii) have market capitalizations greater than $30 billion. In the rest of this Section, we refer to these registrants as the “$30 billion cohort.”

Solely for purposes of comparing the length of HCR disclosures, to provide an apples-to-apples comparison against our prior Alert, we also studied the length of the disclosures for the last 50 registrants with a greater than $1 billion market capitalization who filed a Form 10-K on or before March 1, 2021. In the rest of this Section, we refer to these registrants as the “March 2021 $1 billion cohort” and we compare it to the “November 2020 $1 billion cohort” from our prior Alert.

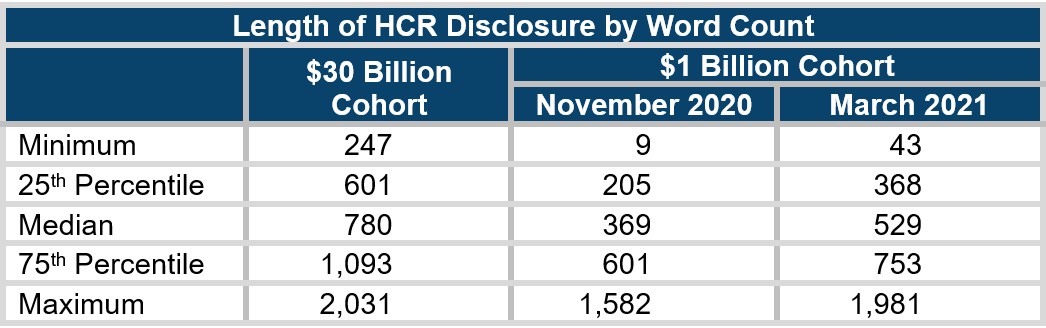

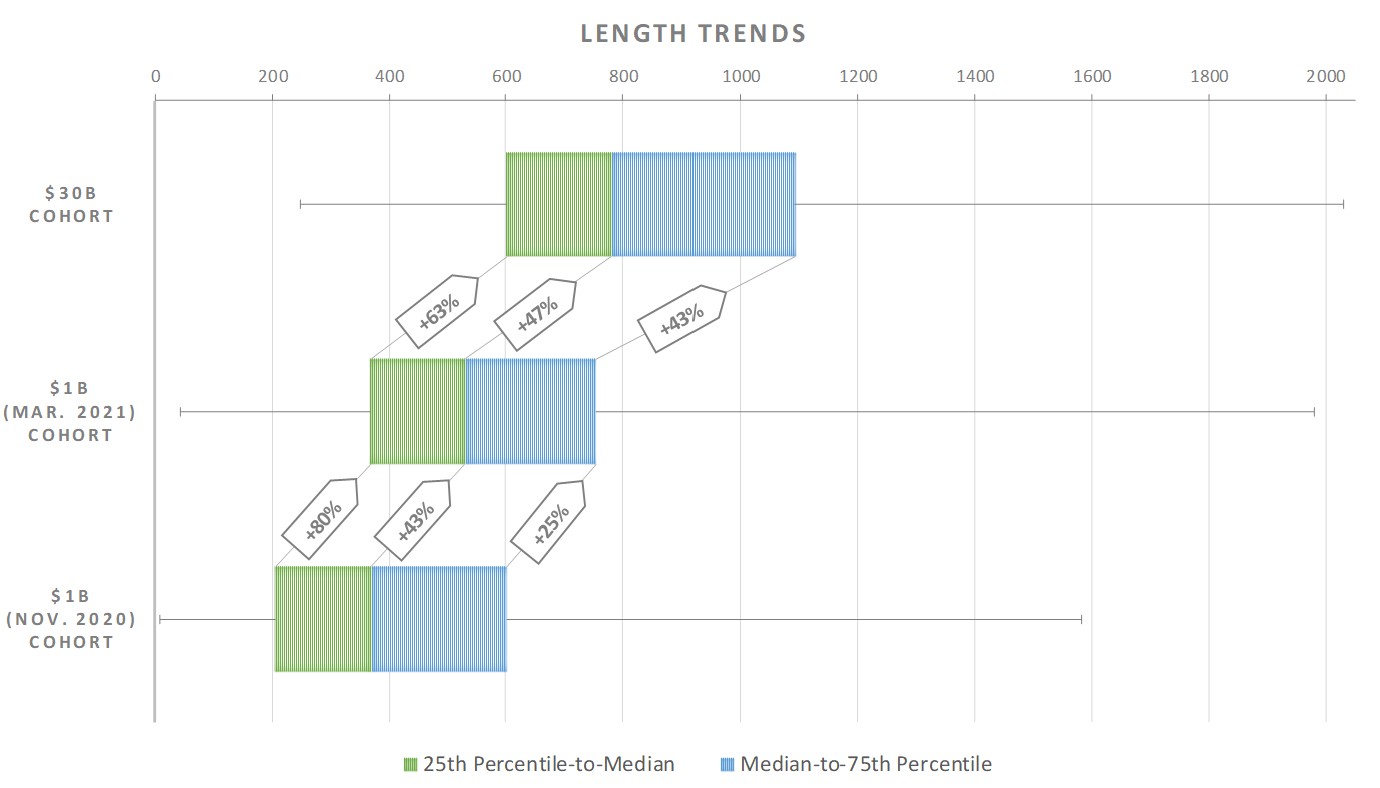

Length

As predicted in our prior Alert, the length of HCR disclosures increased as the filing season progressed. Additionally, the length of larger registrant disclosures is significantly greater than smaller registrant disclosures, with excerpts ranging from 247 to 2,031 words in length, with a median of 780 words. For context, the median is approximately 110% greater than the 369-word median observed in the November 2020 $1 billion cohort. While the former comparison is not quite apples-to-apples ($30 billion versus $1 billion), the median length also increased by approximately 40% (from 369 words to 529 words) for the $1 billion cohort from November 2020 to March 2021. The below table and graph that follows illustrate a clear trend – both the shortest and longest disclosures are getting longer, with increases at the 25th, 50th, and 75th percentiles respectively.

Unlike the November 2020 $1 billion cohort, where eight registrants essentially repeated the disclosure from their prior 10-K (i.e., maintained the previous standard of simply listing employee headcount), all of the registrants in the $30 billion cohort provided varying levels of more robust disclosures than in their prior year 10-K filing.

This Alert covers observed trends and is not intended to imply (nor do we believe) that registrants disclosing on the lower end of the word count-spectrum necessarily have inferior disclosures. Moreover, while the focus of this Alert is on the HCR disclosures included within 10-K filings, as we discuss in further detail below, many registrants are cross-referencing other sections of the 10-K, sustainability reports, proxy statements, corporate websites, and other sources of additional information, which, if taken into account, augment the length (and content) of the applicable disclosures.

Topics

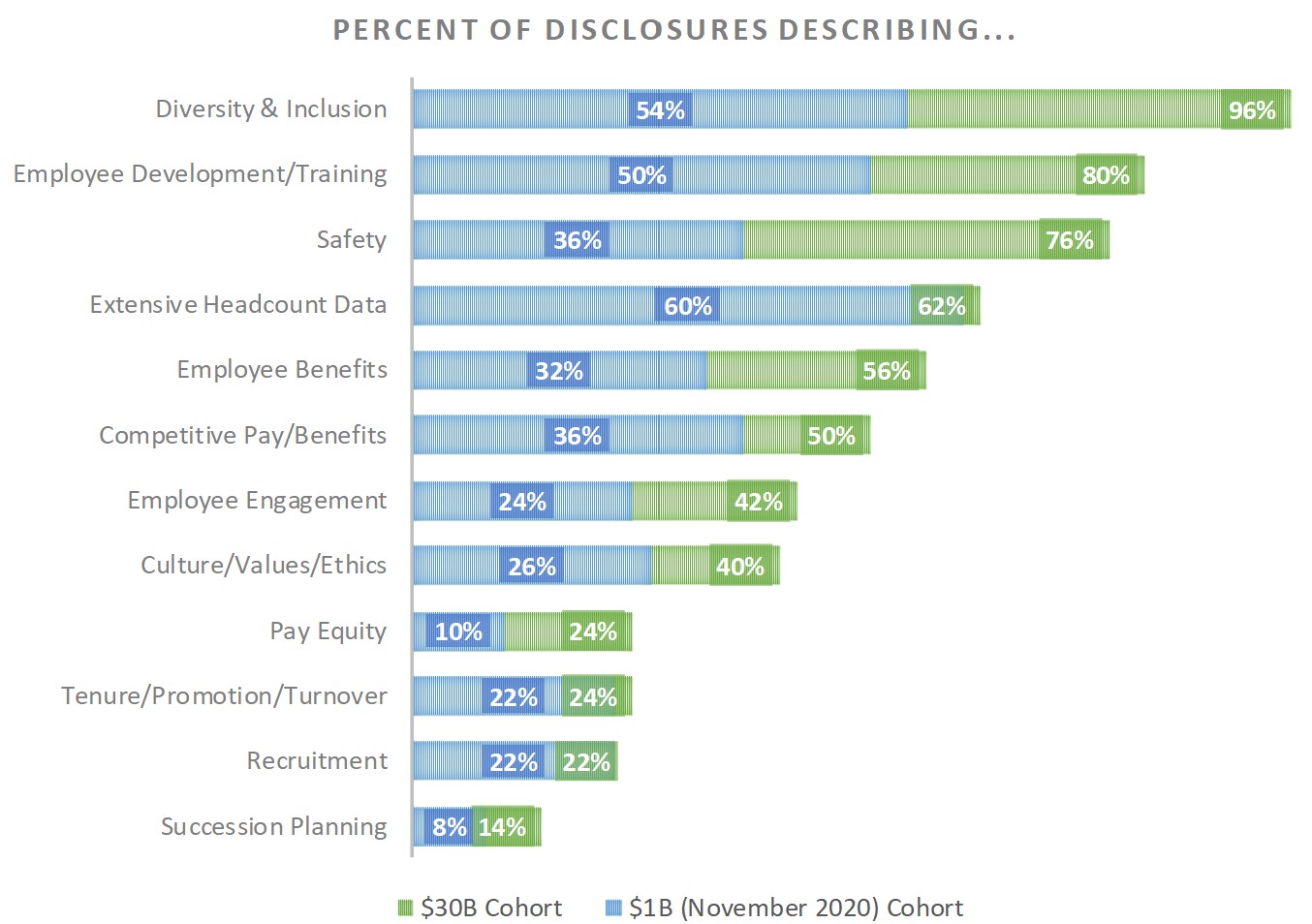

We looked at the same topics explored in our prior Alert, which we found to still capture the breadth of topics typically included within HCR disclosures. Just as before, we attempted to only give credit for a topic if the discussion was more than a brief mention. For example, if a registrant’s disclosure was only that it considered diversity, recruiting, training, compensation, and benefits all to be important factors in its HCR strategy, we treated the registrant as not getting credit for any of these factors. Thus, our test for “significance” is inherently subjective, to an extent. Further, it bears repeating that the results of the study are entirely dependent on the HCR disclosures themselves – in other words, we did not take cross-referenced materials into consideration.

D&I was the most frequently discussed topic (often in great depth), with 96% of the registrants providing a detailed discussion (see the Diversity & Inclusion subsection within the HCR Disclosure Trends section that follows). This is up from 54% within the November 2020 $1 billion cohort. The second and third most common topics of discussion relate to Employee Development and/or Training opportunities (80% up from 50% within the November 2020 $1 billion cohort) and Employee Safety (76% up from 36% within the November 2020 $1 billion cohort), be it general or COVID-19 related. Most of the topics we tracked were discussed much more often within the $30 billion cohort.

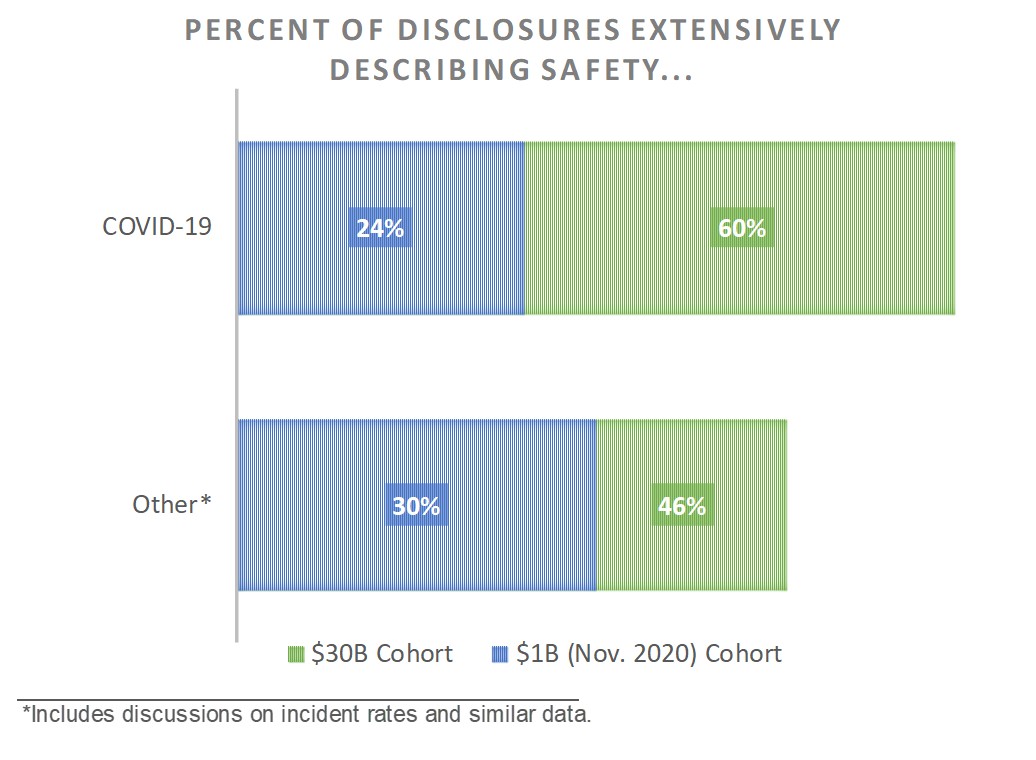

Like last time, we analyzed both general safety disclosures and COVID-19-related safety disclosures. As seen below, the $30 billion cohort discussed each of these topics more often than the November 2020 $1 billion cohort. Please note that data reflected in both charts are cumulative (e.g., 24% of the November 2020 $1 billion cohort discussed COVID-19 in detail, where 60% of the $30 billion cohort did).

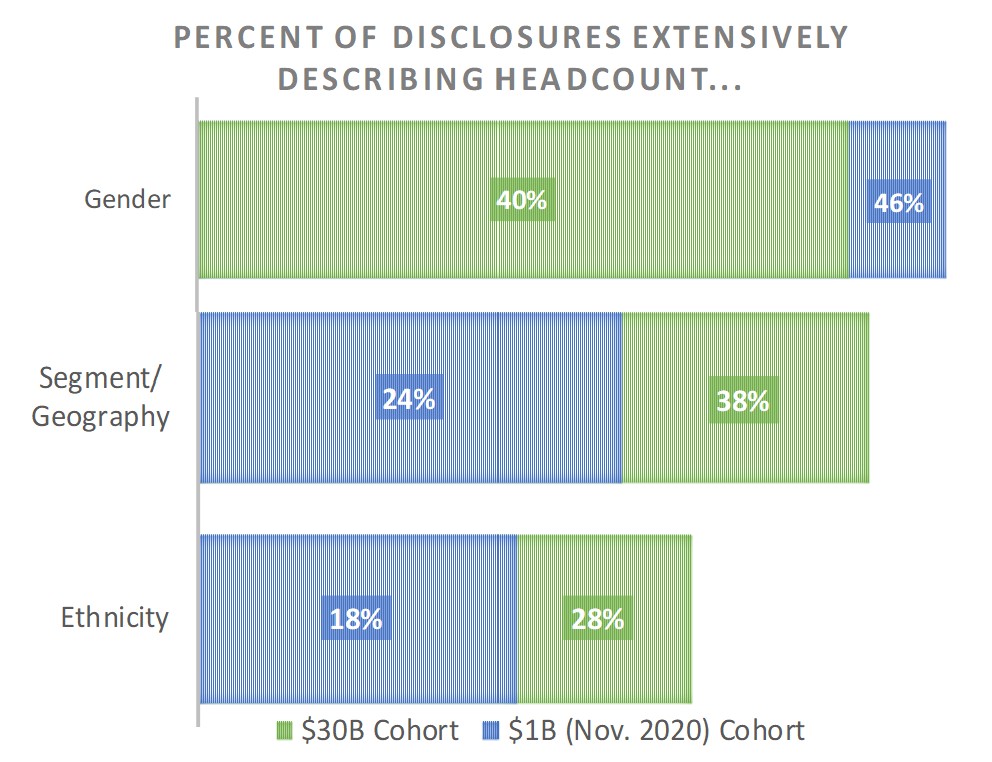

In terms of headcount and demographics, the $30 billion cohort again more often covered each sub-topic (i.e., Gender, Segment/Geography, and Ethnicity), except Gender, where 23 registrants in the November 2020 $1 billion cohort provided extensive disclosure, versus 20 registrants in the $30 billion cohort.

In terms of headcount and demographics, the $30 billion cohort again more often covered each sub-topic (i.e., Gender, Segment/Geography, and Ethnicity), except Gender, where 23 registrants in the November 2020 $1 billion cohort provided extensive disclosure, versus 20 registrants in the $30 billion cohort.

HCR Disclosure Trends

Diversity & Inclusion

While D&I was already one of the most prevalent topics of discussion among the November 2020 $1 billion cohort (54%), it became a nearly unanimous topic of discussion among the $30 billion cohort (96%). There were only two registrants that did not get credit for covering this topic, each of which make passing mention of D&I, and importantly, cross-referenced a well-developed diversity or sustainability report that is full of D&I-related disclosures.

As might be expected, most disclosures on this topic emphasize the importance of D&I to the organization and the registrant’s commitment to supporting, and in many cases improving, D&I. Under the D&I heading there were two items that came up in a significant number of disclosures: discussion of affinity groups and discussion of diversity councils and/or leadership positions. Approximately 56% of the $30 billion cohort discussed the use of affinity groups, most commonly labeled as employee resource groups (ERGs), but also referred to as business resource groups, colleague resource groups and other similar names. Disclosures typically focused on the purpose of these groups such as promoting an inclusive work environment, creating a space for connecting on shared experiences, and supporting recruiting, mentorship and career development. Oftentimes the disclosures also note the number of groups, types of groups, leadership of the groups and membership numbers. Approximately 42% of the $30 billion cohort discussed existing or newly created D&I leadership positions and/or councils, thereby underlining the importance that the registrant places on D&I. Diversity councils are typically described as cross-functional teams that include members of senior management and serve as D&I ambassadors across the company with oversight of D&I programs.

Other commonly discussed D&I topics included: D&I-related training opportunities (about 28%), disclosure regarding the percentage of diverse (by gender or ethnicity) members of the board of directors and/or senior leadership (about 24%), and commitments to future diversity (gender or ethnicity) goals (about 16%). D&I discussions often overlapped with the discussion of recruiting, where emphasis is made on efforts to ensure fair and equitable hiring practices and to recruit from a diverse slate of candidates. Likewise, in several cases, discussions of employee engagement and pay equity included mention of D&I. Where D&I-related accolades have been earned, those are often listed as well.

There is no doubt that D&I will remain a topic in most HCR disclosures, and take up significant real estate therein. Consistent with broader trends related to Environmental, Social and Governance (ESG) topics, we predict that there will be continued movement towards more meaningful and concrete disclosures in this area.

Tenure, Promotion and Turnover Data

It is reasonable to believe that many investors are interested in statistics with regard to a registrant’s recruiting and retention efforts. All else being equal with respect to two registrants (same industry, geographic area, rate of growth, etc.), an investor might conclude that a registrant is more effectively managing its human capital resources if it has a higher success rate in recruiting and a lower rate of voluntary terminations, within comparable positions. We thus examined the 10-K sample to see what data was made available.

The primary takeaway is that data disclosure with respect to these topics is still quite limited. Of the 50 registrants in the $30 billion cohort, 2 had recruiting data, 10 had turnover data, and 3 had tenure data. The data showed:

- Job offer acceptance rates from 74% to 82%

- Average tenure from 8 to 15 years

- Overall turnover rates from 4% to 21.7% (5 registrants)

- Voluntary turnover rates from 3% to 10.6% (6 registrants)

While the data is interesting, the sample size is far too limited to draw any conclusions. Moreover, we would expect the data to be skewed toward the better performing registrants--a registrant concerned that its turnover rate is high strikes us as less likely to disclose the data.

Another concern we have with any attempt to generalize is that there may be differences in how the data is being computed. One registrant referred to its “salaried talent retention rate.” While we treated its percentage as its overall turnover rate (therefore, including persons leaving on account of death, disability, and retirement), we are not sure if that is what was intended by the quoted language. So, unless a registrant includes a definition of how it is computing turnover, one cannot be sure the data of different registrants has been computed identically. One set of guidelines in this area defines turnover as X/Y where X is the total number of persons leaving over a particular time period (for example, one year) and Y is the average headcount over the same period. That strikes us as a relatively straightforward definition, which could be used to compute both overall and voluntary turnover, depending on how X is defined.

Finally, it bears emphasis that we think it could be misleading for an investor to draw conclusions with respect to turnover and related topics by just looking at 10-K HCR disclosure averages. For example, we expect turnover data varies significantly by industry. So, while we consider these statistics potentially quite helpful, they need to be considered carefully in the appropriate context.

Cross-References

Another topic that we analyzed in this update is the extent to which registrants supplemented their HCR disclosures by references to other materials, be it sections of the annual report or otherwise. Twenty-two of the 50 registrants in our $30 billion cohort used supplemental references, in some cases more than one reference (there were a total of 27 cross-references). This is an important statistic. Gauging the completeness of a registrant’s disclosure only by the HCR section does not capture the extent of its disclosure if there are cross-references. We still think it useful to show data with respect to just the HCR disclosures (since the HCR should contain the most material information), but that is not the end of the story.

There was significant variation among the cross-references:

- 11 cross-references to general reports by the registrant on ESG factors, which reports bore different names such as “sustainability report,” “corporate responsibility report,” “corporate social responsibility report,” and “ESG report.”

- 1 reference to a registrant’s inclusion report.

- 5 references to the risk factors portion of the 10-K.

- 3 references to the MD&A section of the 10-K.

- 4 references to the proxy statement.

- 2 references to the registrant’s website, in one case for a discussion of talent development and engagement, and in the other to demonstrate that its executive officers were primarily internal promotions.

- 1 reference to the financial statements for a discussion of the registrant’s benefit plans.

Many registrants noted that the referenced information was not meant to be incorporated into the annual report by virtue of the cross-reference.

We will continue to monitor the use of cross-references since we think it is a useful technique for a registrant that believes that some investors would appreciate a lengthier HCR disclosure and others would prefer a shorter discussion. The cross-reference technique can satisfy both constituencies, particularly if the registrant has already determined to publish a report on the applicable topic. In that regard, we were struck by the fact that, despite the recent increased attention on ESG topics and related reports, only 22% of the largest registrants cross-referenced having such reports in their HCR disclosures.

As illustrated by the one registrant that cross-referenced its website for additional talent development/employee engagement data, it is possible to provide additional data without creating a formal document. This could be a promising approach for registrants who would like to expand their discussion of HCR issues but have not embarked upon the complexities of producing a complete ESG report.

***

With thanks to Hannah Reich, Daisy Laska, and Emma Van Beek, who provided research support for this Alert.

Share: