Lessons Learned from Early Filers: Insights into Incentive Compensation Decisions in the COVID-19 Environment

Share

The COVID-19 outbreak has caused major disruptions across businesses worldwide, and there are wide-ranging implications for the administration of compensation programs. While most calendar-year companies have several months left to determine how they will handle their in-cycle incentive plans, many companies have already made decisions given their non-calendar fiscal year ends.

FW Cook is actively tracking the year-end compensation decisions made by S&P 1500 companies with fiscal years ending in April, May and June (“early filers”) as they publish their 2020 proxy statements to provide insight as to how calendar year companies may approach year-end decisions. It is important to note that the impact of COVID-19 was less pronounced for the early filers (i.e., impact generally limited to two to four months) than calendar year companies that are potentially facing up to 10 months’ impact. As such, 2020 incentive decisions for calendar year companies may vary in prevalence and magnitude.

Preliminary findings indicate that use of positive discretion to increase payouts in the short- and long-term incentive plans just completed is limited. However, at the companies that have exercised such discretion, the increase in payouts is sizable.

Key findings from our 59-company sample are as follows:

Annual Bonus Plans

FW Cook Commentary:

FW Cook Commentary:

- We believe this approach to pro-rate the payout is an important signal to investors of the trade-offs that are necessary to deliver fair incentive plan outcomes to management participants who have faced huge challenges outside of their control, while recognizing that many shareholders are facing negative returns and rank-and-file employees have also made sacrifices (e.g., furloughs and layoffs)

- Unfortunately, for most calendar year companies, measuring performance through the onset of the pandemic is unlikely to be a feasible approach because the pandemic impacted the majority of the year

- Instead, calendar year companies that decide to exercise positive discretion to increase the formulaic bonus outcome will need to articulate a more holistic rationale for the higher payout that is tailored to their individual facts and circumstances

- Common themes we have observed in working with our clients include post-pandemic absolute financial performance, relative performance versus key industry peers, the shareholder experience, and the execution on the operational and supply chain challenges that arose from the pandemic, including safeguarding the health and safety of employees, suppliers and customers

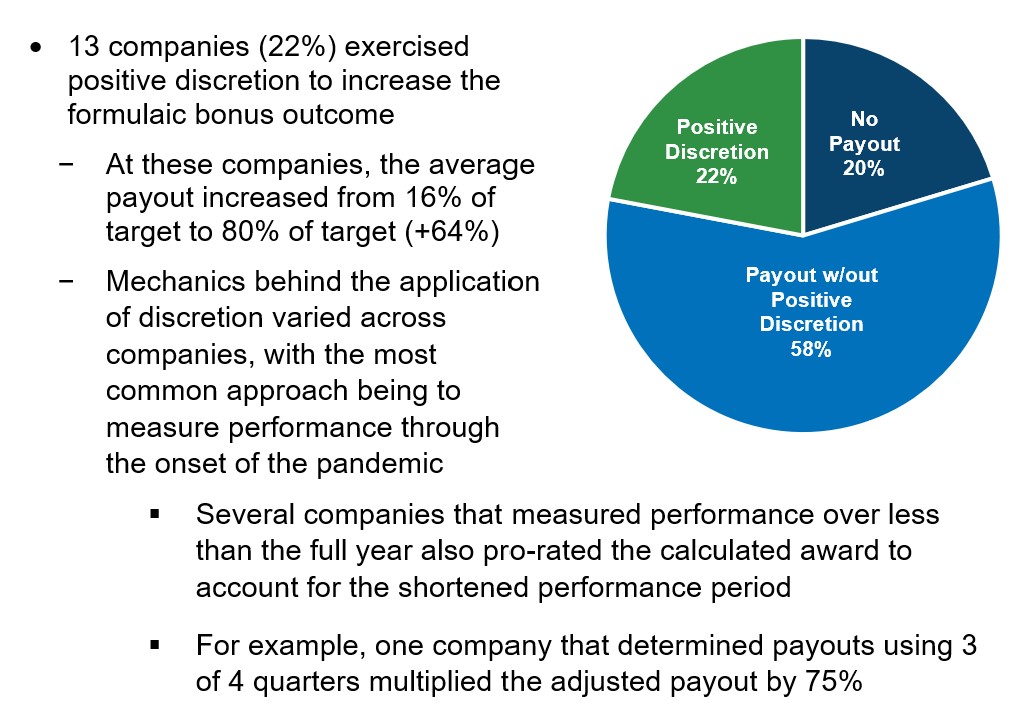

- 34 companies (58%) delivered a payout without exercising positive discretion, with an average payout of 97% of target

- 12 companies (20%) delivered zero payout and did not exercise positive discretion

- This includes two companies that exercised negative discretion to decrease the formulaic bonus outcome to zero, despite financial performance that would otherwise have funded an award

- 12 of 13 companies exercising positive discretion had purely formulaic bonus plans

- Conversely, at the other 46 companies, about half had a non-financial component in the bonus plan or some other means by which to award a payout even when the financial component did not fund

- For companies that specifically weight non-financial performance as a component of their bonus plan, financial performance funded at an average payout of 65% of target, while non-financial performance funded at an average payout of 116% of target (+51% higher for non-financial)

- Overall, these companies provided an average payout of 79% of target because of a higher weighting on financial compared to non-financial performance

Long-Term Incentive Plans – Most Recently Completed Cycle

9 companies (15%) exercised positive discretion to increase the formulaic long-term incentive outcome

- 6 of these companies also exercised positive discretion to increase the formulaic bonus outcome

- At these companies, the average payout increased from 54% of target to 103% of target (+49%)

- As with annual bonus plans, the most common approach to exercise discretion was to measure performance through the onset of the pandemic (for example, to calculate performance using 11 of 12 quarters)

FW Cook Commentary:

- While measuring performance through the onset of the pandemic may not be practical for calendar year companies’ annual bonus plans, we think it is a reasonable approach to explore for long-term incentive plans because meaningful data should be available for 8 or 9 of 12 total quarters

- As with annual bonuses, we think that pro-rating the payout to account for a shortened performance period is an important consideration as Compensation Committees evaluate the appropriateness of exercising discretion with regard to long-term incentive plans

Long-Term Incentive Plans – Outstanding Cycles

Only two companies disclosed modifications to in-cycle performance awards

- One company changed from using absolute financial metrics to relative TSR in their performance cash plan

- One company changed from measuring performance on a 3-year cumulative basis to three separate 1-year periods in their performance share plan

FW Cook Commentary:

We caution Compensation Committees to carefully evaluate a broad array of considerations before proceeding with applying discretion in active, equity-based, long-term incentive plans

- Discretion can take many forms with long-term incentive plans, including, but not limited to, changes to the metrics, changes to the goals, changes to the measurement period and revisions to the adjustments used to calculate performance

- All, however, create a risk of accounting and disclosure complications that could result in incremental accounting cost, increase reported pay in the Summary Compensation Table and even potentially jeopardize the Company’s ability to establish fixed accounting costs for equity-based awards in future years

- We encourage all Compensation Committees to consult with their appropriate accounting and legal advisors to fully understand these issues before any decisions are made

- Additionally, changes to active long-term incentive plans are likely to require a thoughtful, nuanced explanation to investors who may be less open to changes for awards that, by their very nature, cover a long-term performance period

We observed limited prevalence of special awards attributed to the challenges created by the pandemic. Only five companies disclosed such awards, with a variety of instruments (cash, RSUs, premium-priced stock options) used for the awards. All companies indicated that the special awards were made after the fiscal year end, meaning that the actual magnitude will not be disclosed in the Summary Compensation Table until next year’s proxy statement at the earliest.

Looking ahead to next year, we found that about a quarter of the 59 companies prospectively disclosed that they were making changes to their fiscal 2021 annual bonus and/or long-term incentive plans to account for the challenges created by the pandemic. Changes varied widely, with the most common strategies being a delay in goal setting, increased use of non-financial metrics in the bonus plan, and changing the mix of long-term incentives away from performance-based awards in favor of more time-based awards.

Ted Simmons

Ted Simmons

Principal

Ted Simmons advises public and private companies on all aspects of executive compensation strategy and design. He partners closely with his clients’ Compensation Committees and management teams to arrive at effective solutions for the organization that appropriately balance the interests of all key stakeholders. Ted’s clients encompass a wide range of industries, sizes and ownership structures. He is a frequent contributor to the firm’s publications and has managed the firm’s research efforts on the pandemic’s impact on executive compensation.

Tyler Janney

Tyler Janney

Consultant

Tyler Janney’s consulting engagements focus on all aspects of executive and board compensation and he engages with clients, both public and private, in numerous industries and throughout various stages of the business cycle. Tyler specializes in executive compensation trends, annual and long-term incentive program design, peer group development, and the relationship between executive pay and company performance. In 2020, Tyler has supported the firm’s internal COVID-19 compensation adjustment updates.