ISS Releases 2023 Proxy Voting Guidelines and Compensation FAQs

By Joe Sorrentino, Managing Director

Share

Proxy advisor Institutional Shareholder Services (ISS) published its 2023 Proxy Voting Guidelines, which include its benchmark policy changes with respect to U.S. executive compensation. The 2023 policy updates will become effective for meetings on or after February 1, 2023.

In addition, ISS has also released a series of FAQs covering updates and clarifications to compensation policies, equity compensation plans, and peer group methodology.

Compensation Policy Updates

Problematic Pay Practices

While ISS has rewritten its description of “problematic pay practices,” most of the changes are not substantive policy revisions but, rather, a codification of ISS’ current approach.

Most notably, ISS has codified its approach to evaluating executive severance payments in cases where a termination is either not involuntary or not clearly disclosed as involuntary. Specifically, when a termination is not clearly disclosed as involuntary (for example, a termination without cause or resignation for good reason) and severance is paid to the departing executive, there is a significant risk of an adverse say-on-pay vote recommendation.

The description of problematic pay practices has also been adjusted to clarify that such practices are not limited by the phrase “non-performance-based pay elements.” As such, practices can include performance-based pay elements that ISS deems to be problematic. The use of these practices may lead ISS to issue an adverse say-on-pay vote recommendation. The update also makes clear that the list provided in the benchmark policy – which includes liberal change in control provisions with single trigger benefits, extraordinary perquisites or tax gross-ups, and repricing stock options – is not exhaustive.

Additional detail on the list of problematic pay practices is provided in the U.S. Compensation Policies FAQ.

Consideration of SEC’s Pay versus Performance Disclosure Rule

While the new Pay versus Performance disclosure will not be incorporated into ISS’ quantitative pay-for-performance screen, these disclosures may be considered during the qualitative evaluation, particularly for companies that exhibit a quantitative pay-for-performance misalignment.

ISS also noted that research reports will display most elements from the company's disclosed Pay versus Performance table, including the Summary Compensation Table total pay figure for the CEO, the Compensation Actually Paid value, the company's TSR, the peer group's TSR, the company's most important financial metric, and the other disclosed important metrics for determining CEO pay.

Quantitative Pay-for-Performance Screens

While there are no changes to the three primary screens (RDA, MOM and PTA) for 2023, there are updates to the methodology for the Financial Performance Assessment “FPA” measure as well as the "Eligible for FPA Adjustment" thresholds.

Historically, the FPA potentially impacted the overall quantitative concern level for companies which were (i) a Medium concern under any of the three primary screens, or (ii) a Low concern but bordering the Medium concern threshold (categorized as “Eligible for FPA Adjustment”) under any of the primary quantitative screens. Beginning with February 1, 2023 meetings, potential FPA adjustments will expand to cover more companies beyond only borderline Low concern and Medium concern cases.

Under the updated FPA methodology, certain High concern companies with strong FPA performance may become Medium concerns, while certain Medium concerns may become High concerns if FPA performance is poor.

Specific details regarding the changes to the FPA measure for 2023 will be provided in an update to ISS' Pay-for-Performance Mechanics white paper, which will be published in January. According to ISS' back-testing, slightly less than 10% of all companies subject to the quantitative screen will have their overall quantitative concern level modified by the FPA.

CEO Transition Pay

In a new FAQ for this year, ISS noted that the presence of inducement and/or make-whole awards may mitigate concerns regarding pay magnitude if a review of the award structure and disclosure reveals positive features. ISS also expects pay levels to normalize following the CEO transition in situations where compensation is elevated in the transition year.

Inducement awards should be predominantly performance-based and structured with appropriate “shareholder-friendly guardrails” and ISS notes the limitations on award vesting in the event of a termination as a desired “shareholder-friendly” feature. ISS requests clear disclosure in this area, including how a company determined the size and structure of inducement awards to be in shareholders' best interests; a statement that acknowledges make-whole awards are economically equivalent to what was forfeited at the prior employer; detailed termination terms and other relevant information to allow investors to assess the award; and the portion of awards that are attributable to inducement awards versus those that are strictly make-whole awards.

Modifier Metrics

ISS recommends companies provide clear disclosure in the proxy statement related to a modifier metric's mechanics, including its applicable goals, the achieved performance level, and impact on payouts. The disclosure should also describe the limitations that a modifier metric has on payouts (i.e., "may increase or decrease the total bonus payout by up to 15%").

Modifier metrics that allow for a significant increase in a payout or do not disclose the percentage by which a payout can be increased may be viewed negatively, as will modifier metrics that contribute to what ISS deems to be an “overemphasis” of committee discretion within the pay program. We note that “overemphasis” is not further defined or clarified.

Complex Pay Programs

ISS cautions that overly complex pay programs may impede investors' ability to evaluate the linkage between pay and performance and reduce transparency. ISS may raise concerns when a pay program contains overly complex features, particularly when a quantitative pay-for-performance misalignment is identified. ISS cites a disproportionately large number of metrics, modifiers, and/or award vehicles, complicated vesting or award determination formulas, or convoluted disclosure without clear and compelling rationale as examples of overly complex pay programs.

Equity Compensation Plan Updates and FAQs

Increases to Equity Plan Scorecard (“EPSC”) Thresholds

ISS announced that the threshold passing scores for its EPSC model will increase for the S&P 500 (from 57 points to 59 points out of a total of 100), the Russell 3000 (from 55 points to 57 points), and the Non-Russell 3000 (from 53 points to 55 points). Other than the change to burn rate calculations described below, there are no new factors or score adjustments.

Value-Adjusted Burn Rate

Burn rates, also known as run rates, measure the annual usage of shares by company equity incentive plans. ISS’ new Value-Adjusted Burn Rate (VABR) was announced in the 2022 policy updates, subject to a one-year transition. Now that the transition period has expired, the new burn rate calculation methodology will be effective for meetings on or after February 1, 2023. The annual VABR calculation is as follows:

((#of options*option’s dollar value using a Black-Scholes model) + (# of full-value awards*stock price))/(Weighted average common shares*stock price)

In addition to the change to the burn rate calculation which resulted in the VABR, ISS has also changed the way it calculates its burn rate benchmarks used to compare individual company share usage.

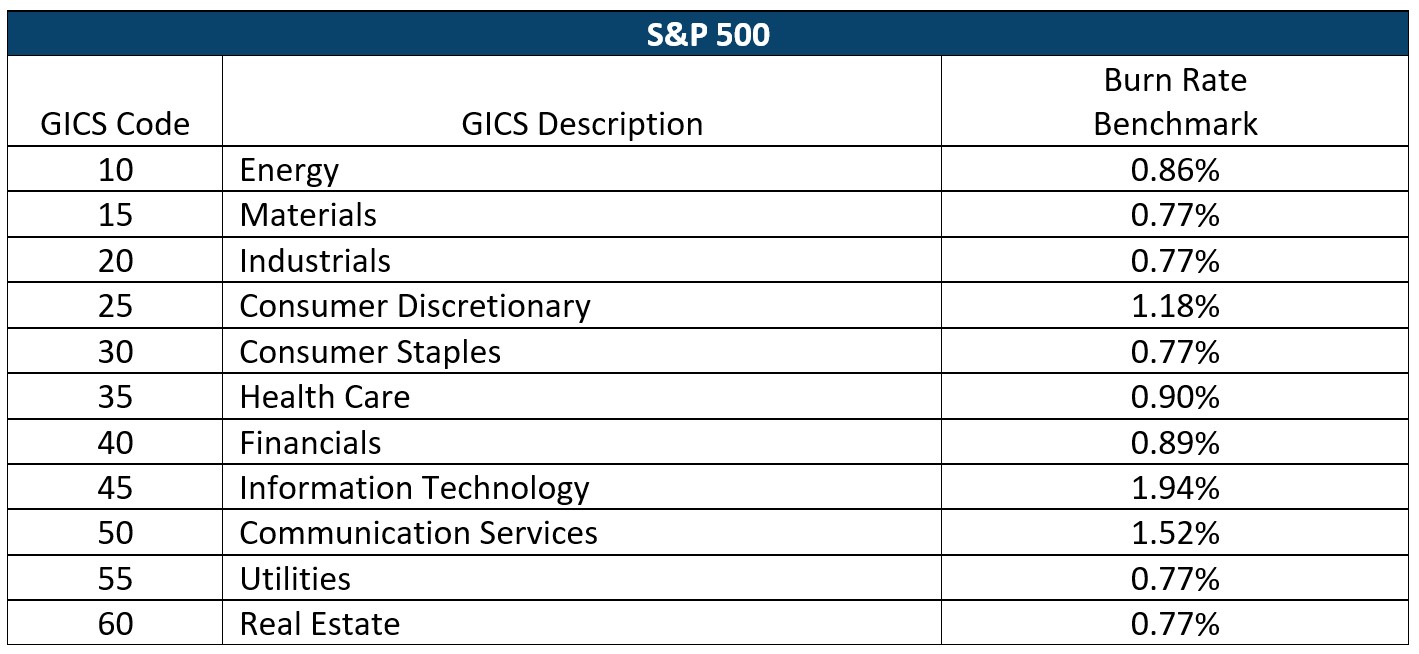

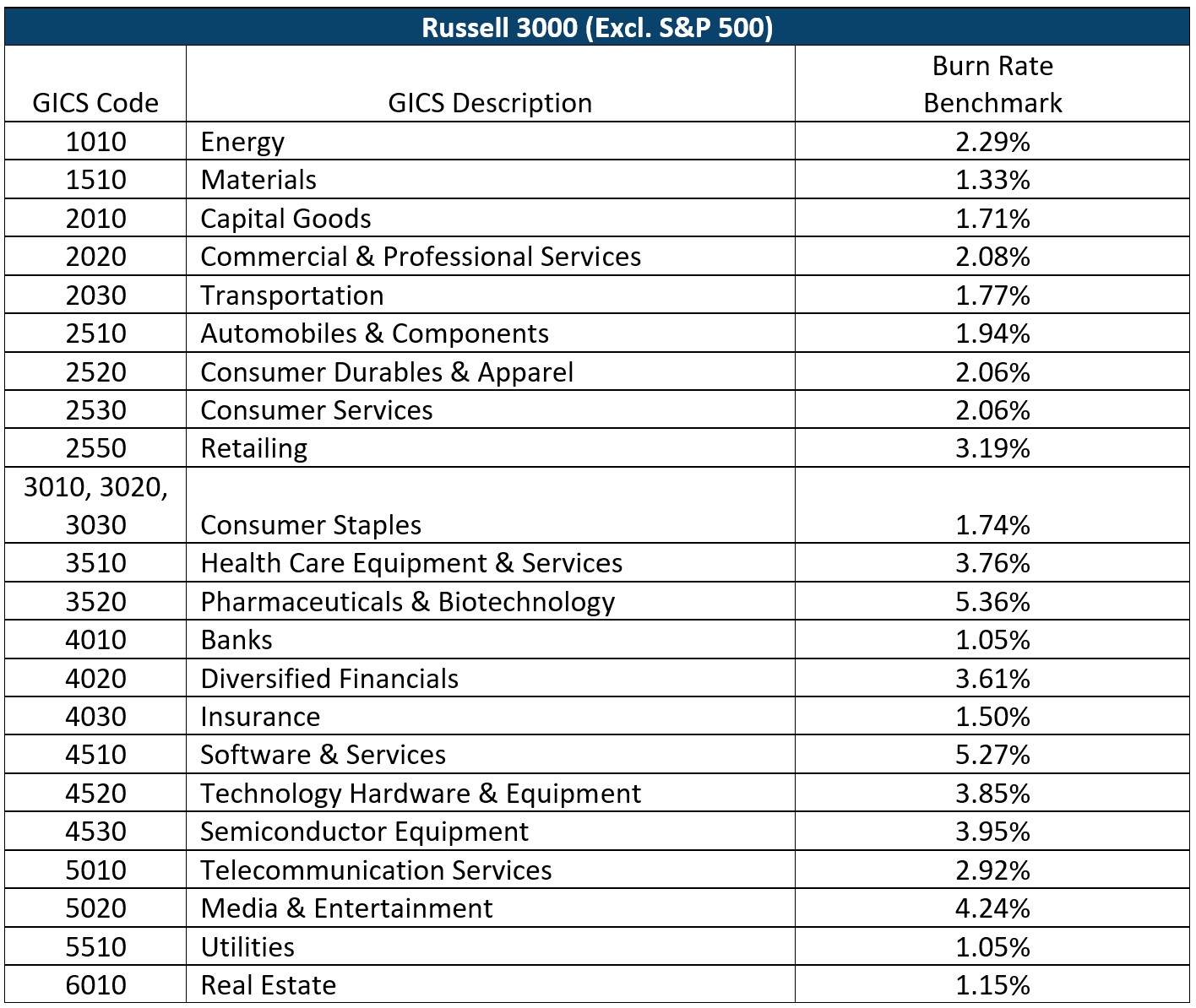

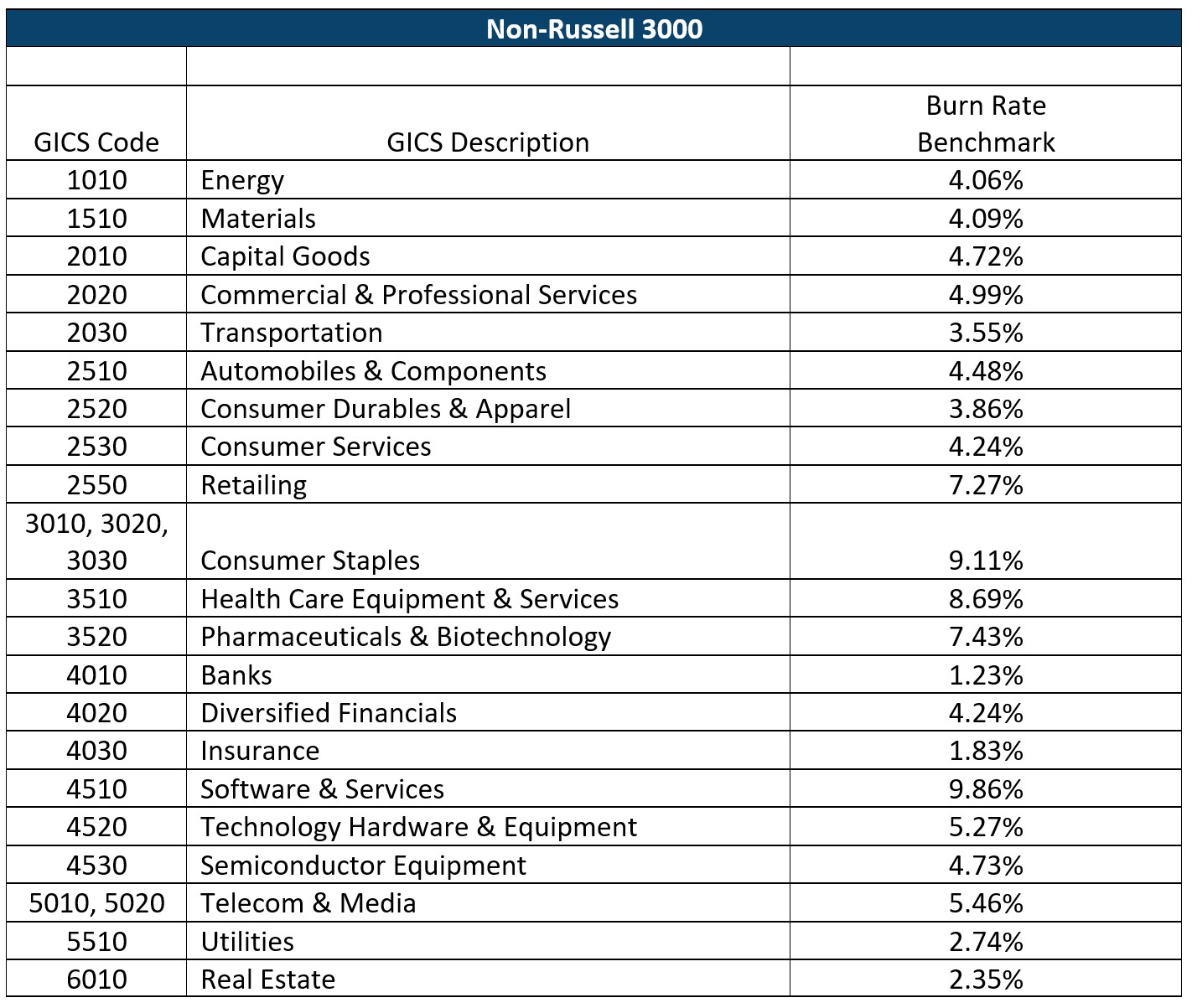

The benchmarks are based on an industry-specific threshold based on three-year average burn rates within the company's GICS group, subject to a “de minimis threshold.” GICS groups are also broken down by three index groups: the S&P 500, the Russell 3000 excluding the S&P 500, and companies outside the Russell 3000.

The “de minimis threshold” for each of the index groups has been established as follows: 0.77% for the S&P 500, 1.05% for the Russell 3000 excluding S&P 500, and 1.23% for companies outside the Russell 3000.

ISS notes that benchmarks will only be adjusted marginally each year, if at all. GICS industry benchmarks can be found below:

Clawback Policy

In order to receive EPSC points for the clawback policy factor, the policy should authorize recovery upon a financial restatement and cover all or most equity-based compensation for all NEOs (including both time- and performance vesting equity awards). Note that a clawback policy that adheres to the minimum requirements of the SEC’s finalized clawback rules under Dodd-Frank will not receive EPSC points, because the final rules generally exempt time-vesting equity from compensation that must be covered by the policy.

Global Industry Classification Standard (GICS) Codes Modifications

As previously announced and summarized here, revisions to GICS codes will be effective March 17, 2023. For EPSC purposes, the GICS changes will be effective for shareholder meetings which occur on or after September 1, 2023.

Peer Group FAQs

Updated Peer Group Disclosure

ISS added one update to its Peer Group Selection FAQ clarifying that it would expect any updated list of peer companies submitted to ISS to match the benchmarking peers that are disclosed in the upcoming proxy.

If the peers submitted to ISS through this process are different from the peers disclosed in the upcoming proxy, ISS may apply additional scrutiny to this variance as part of its pay-for-performance analysis. If there is a significant unexplained discrepancy between submitted peers and those disclosed in the proxy, ISS may in its discretion remove a company from a future peer submission process.

ISS also encouraged issuers to disclose in the proxy the stock ticker for each peer alongside the peer company name to provide for greater certainty that ISS and investors are considering the correct peers.

Joe Sorrentino

Joe Sorrentino

Managing Director

Joe Sorrentino has over 20 years of executive compensation consulting experience. His client assignments have been with both public and privately-held companies in industries including: chemicals, consumer products, financial services, health care, manufacturing, pharmaceuticals, real estate/REITS and utilities. His consulting engagements often focus on the development of executive compensation strategy, design of annual and long-term incentive programs, and ISS equity plan modeling, compensation and governance policies.