Could Stock Options Make a Comeback?

By Michael J. Kenney, Erin Bass-Goldberg

Share

Introduction

Love them or hate them, everyone has a point of view on stock options. Some people credit them for driving a growth culture, while others blame them for promoting undue risk-taking in corporate America. Given evolving shareholder perspectives on performance-based pay and volatile market conditions, it begs the question: could stock options make a comeback?

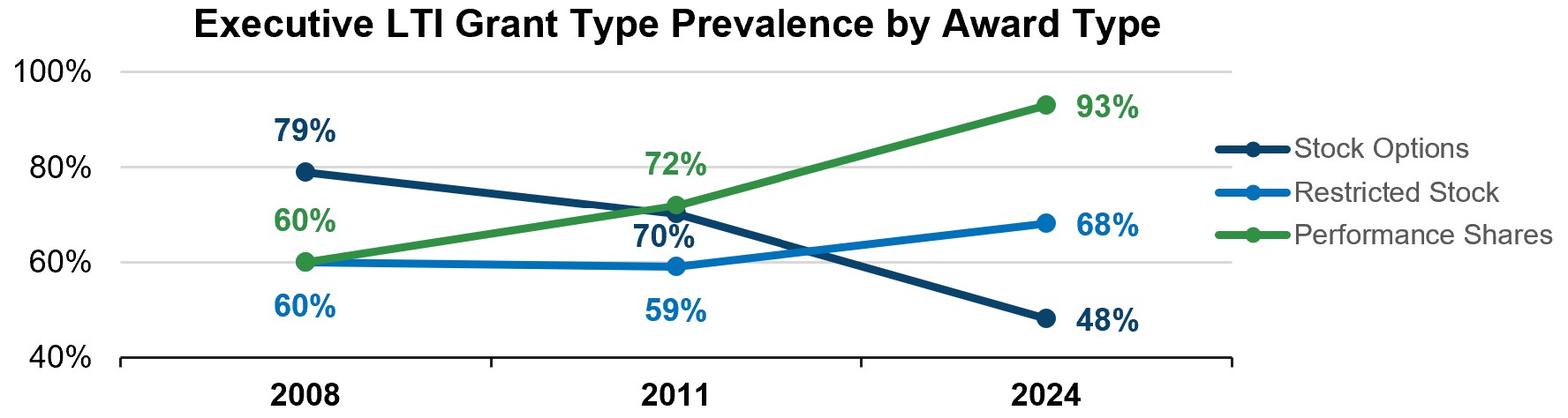

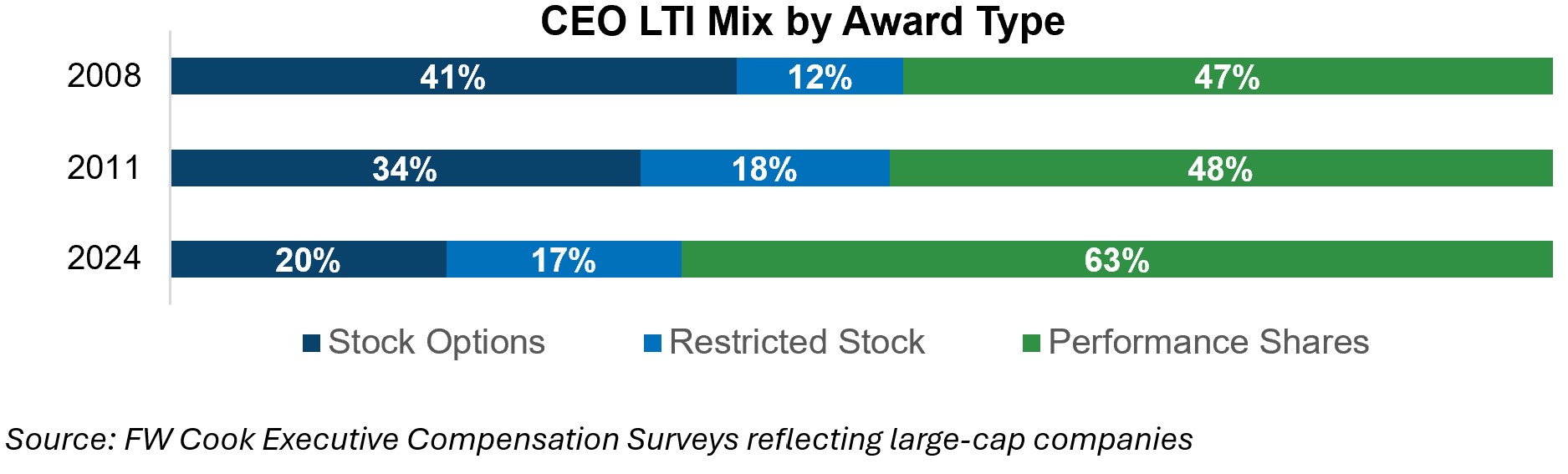

Since 1973, FW Cook has been reporting on top officer long-term incentive (LTI) trends among the 250 largest companies as measured by market capitalization. The 2007 and 2008 FW Cook Top 250 Long-Term Incentive Reports described the reallocation of long-term incentives from stock options as the sole LTI vehicle to a portfolio approach of stock options and full-value shares (performance shares or restricted stock1). The primary driver of the change was the implementation of Accounting Standards Codification (ASC) Topic 718 (formerly known as FAS 123R), which resulted in a charge to earnings for granting stock options and a greater focus on controlling potential shareholder dilution. A few years later, the 2011 FW Cook Top 250 Long-Term Incentive Report marked the first time in the history of the report that the prevalence of performance shares was higher than stock options, reflecting the advent of Say on Pay and the increased influence of proxy advisors, such as Institutional Shareholder Services (ISS) and Glass Lewis. Neither ISS nor Glass Lewis credits time-based stock options as performance-based, so companies implemented performance shares at higher rates to receive credit for performance-based LTI programs and bolster the likelihood of a “For” vote recommendation on Say on Pay from the proxy advisors.

In 2011, 72% of the Top 250 companies granted performance shares to their top officers. Since 2011, the use of performance shares has continued to increase, to the point that by 2024, nearly all Top 250 companies granted performance shares. Meanwhile, the use of stock options has decreased to less than half of the Top 250 companies, and nearly 70% grant restricted stock to top officers.

The following graphs present LTI information for three different time periods: the year preceding the implementation of ASC Topic 718 (2008), the first year of Say on Pay (2011), and the most recently disclosed year (2024).

The increase in the prevalence of performance shares has been accompanied by a higher allocation of LTI mix to performance shares, increasing from below 50% in 2008 and 2011 to above 60% in 2024. This increased allocation aligns with the proxy advisors’ policies of giving credit for a performance-based LTI program to companies that grant at least 50% of LTI in performance shares.

2025 Proxy Advisors Annual Policy Surveys

ISS recently released its Annual Global Benchmark Policy Survey, addressing several executive compensation topics, including time- versus performance-based long-term incentives. Prior ISS polling indicated that some investors perceive performance shares as overly complex, costly, and occasionally rewarding the achievement of non-rigorous goals, noting that the standard three-year performance period could encourage sub-optimal decisions. Some investors advocate replacing all or a portion of performance shares with time-based restricted stock with long-horizon vesting and/or post-vest stock retention requirements to promote actions that drive long-term shareholder value. In the July 2025 survey, ISS is exploring the following vesting/post-vesting retention period combinations for time-based awards to be considered sufficiently long-horizon to obviate the need for a U.S. market company to have performance requirements:

- Three-year vesting period plus at least a two-year post-vesting retention requirement

- Four-year vesting period plus at least a one-year post-vesting retention requirement

- Five-year vesting period without a retention requirement

Glass Lewis is also probing institutional investors’ views on the “reasonable” use of time- versus performance-based LTI in its 2025 Policy Survey.

Implications

An ISS and/or Glass Lewis policy change could lead to significant changes in LTI program design, with some companies replacing all or a portion of performance shares with long-horizon time-based equity awards. While companies could grant long-horizon stock options or restricted stock, we think most companies will choose restricted stock for two key reasons – (1) full-value restricted stock is an analogous replacement for full-value performance shares, and (2) if companies do grant stock options, they will likely want to retain the most common approach of three- or four-year pro rata vesting (as opposed to long-horizon vesting) to provide more flexibility for employee exercisability given higher levels of stock price risk inherent in stock options.

Assuming some companies shift performance shares to long-horizon restricted stock, an apparent implication of this potential policy change could be an increase in the prevalence and weighting of restricted stock grants to top officers2. However, the use of long-horizon restricted stock may indirectly invite a resurgence in the use of “typical time-based” stock options. The remainder of this blog post provides our reasoning for why this could happen.

Reasons for the Resurgence of Stock Options

1) Maintain Leverage in LTI Programs

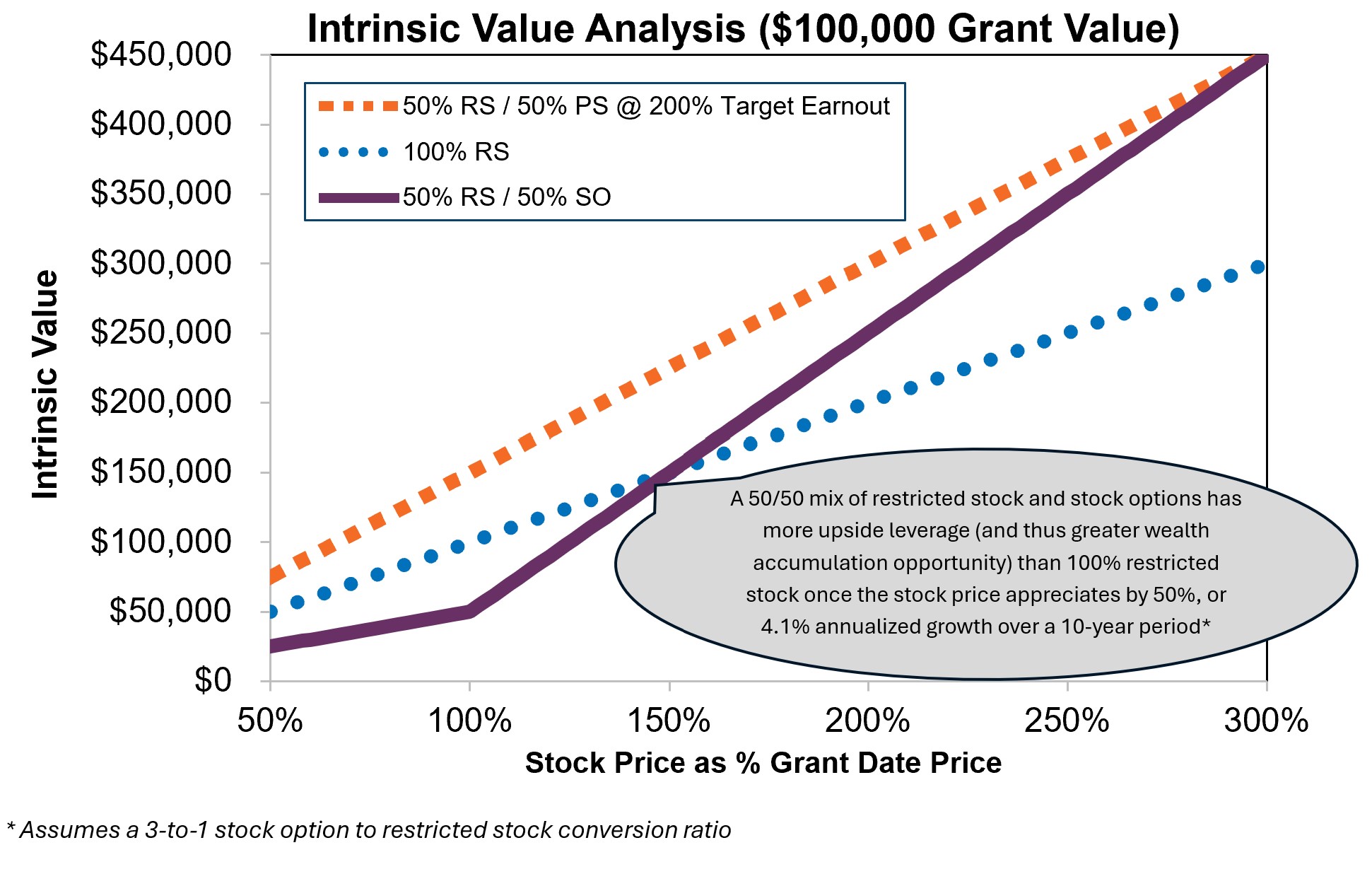

Performance shares provide upside leverage through both the potential to earn an above-target number of shares based on performance, as well as increases in stock price/total shareholder return (TSR) (i.e., “double leverage”). Replacing performance shares with long-horizon restricted stock will result in a reduction in leverage because restricted stock only provides upside through stock price/TSR increases. This loss of double leverage will lower potential realizable pay outcomes.

Stock options can be used to maintain leverage in the LTI program. Stock options are inherently more leveraged because a greater number of stock options than restricted shares are granted for a given award (typical grant-value trade-off ratio is three stock options for one restricted share). Additionally, in contrast to performance shares that normally have a three-year performance period, stock options normally have a ten-year term, allowing for leveraged, pre-tax wealth accumulation over a much longer period of time.

The following graph illustrates how incorporating stock options with restricted stock offers more potential upside leverage than restricted stock alone once the share price appreciates 50% during the 10-year term, or 4.1% on a 10-year annualized basis.

2) Not All Institutional Investors May View Long-Horizon Restricted Stock as Performance-Based

2) Not All Institutional Investors May View Long-Horizon Restricted Stock as Performance-Based

Institutional investor views on LTI design vary, and some may not share the view that long-horizon restricted stock awards are a suitable substitute for performance-based awards. Some investors may consider stock options to be performance-based – at least more performance-based than time-based restricted stock. Depending on a company’s ownership profile, certain investors may perceive the company as having a performance-based LTI program if they use a blend of long-horizon restricted stock and stock options. To add more certainty that investors (and proxy advisors) assess an LTI program as performance-based while avoiding the need to set multi-year financial goals, companies could add stock price hurdles (i.e., 15% cumulative stock price growth over three years) to stock options before any vesting or could grant premium-priced stock options (e.g., exercise price set above fair market value on grant date), requiring a 10% to 15% increase in the stock price before the executive participates in the stock price appreciation.

3) Higher Market Volatility May Make Stock Options More Appealing

Market volatility increased in 2020 due to the COVID-19 pandemic and has remained elevated. We expect market volatility to continue under the Trump administration. Increased volatility makes stock options more attractive for the following reasons:

- Executives – Higher market volatility generally increases of the chances of more in-the-money exercise opportunities (under the assumption that most equities increase in value over time), which is advantageous for the typical executive who often holds stock options for up to 10 years before exercising.

- Employers – Higher volatilities increase the accounting cost per stock option, reducing share usage requirements in dollar-denominated equity programs. Companies will not drain their share pools as fast, making stock options for top officers more manageable from a share dilution perspective.

Conclusion

As perceptions of performance-based LTI continue to evolve among investors and companies, if ISS responds with a policy change modifying its performance-based LTI policy to credit long-horizon restricted stock as performance-based, we will likely see an uptick in the use of restricted stock at the top officer level. However, we would not be surprised if this is accompanied by a resurgence in companies using stock options for top officer grants. Stock options would enable companies to maintain higher levels of LTI program upside leverage, while still appealing to a broader range of investors evaluating a company’s LTI program as performance-based.

1 Performance shares and restricted stock are also meant to include performance share units and restricted stock units. Although there are some important differences between shares and units, they are not material for this blog.

2Restricted stock is nearly universal below the top officer level. The 2025 FW Cook Executive Compensation Survey reports that 97% of participating companies grant restricted stock to some or all eligible employees, most commonly with three-year ratable vesting

Michael J. Kenney

Michael J. Kenney

Principal

Michael Kenney serves public and private companies of varying sizes and industries. He consults directly with the compensation committees and executive management teams of his clients and the clients of managing directors and principals he supports. Experiences and responsibilities include participating in compensation committee meetings, designing and preparing analytics that support compensation decision-making processes, managing consulting teams responsible for the preparation of client deliverables, and developing ongoing relationships with client human resources teams.

Erin Bass-Goldberg

Erin Bass-Goldberg

Managing Director

Erin Bass-Goldberg serves as the independent advisor to the Compensation Committees of both public and privately-held companies in various industries. Her consulting engagements focus on development of executive compensation strategy, design of annual and long-term incentive programs, and transaction-related executive compensation issues. She is an author and frequent contributor to the firm’s technical papers and studies, and is a speaker on executive compensation issues.