Outstanding Dilution from Equity Compensation at Recent Technology IPOs

By Jin Fu, Alec Lentz

Share

Equity dilution shows the portion of a company that is shared with its employees and is a key measure for venture-backed technology companies that rely on skilled human capital to innovate and grow. FW Cook’s database of recent U.S. IPOs provides a window into the typical amount of equity compensation shared with pre-IPO employees, depending on size or location.

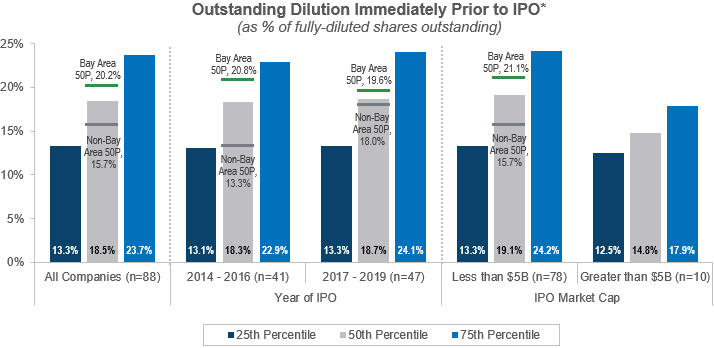

Observations from a sample of 88 venture-backed U.S. technology IPOs suggest that while equity dilution levels have been generally stable over the last six years, (1) differences in practice based on geographic location are disappearing, and (2) company size only makes a difference for dilution levels at the largest pre-IPO companies.

- Median equity compensation dilution at the time of IPO was 18.5%, which has been relatively stable over the last six years.

- Companies in the San Francisco Bay Area share more equity with pre-IPO employees (median is 20.2%) than those in the rest of the country, although the gap is closing as pre-IPO companies outside the Bay Area increasingly share similar amounts of equity.

- Median IPO dilution for companies outside the Bay Area increased from 13.3% between 2014 and 2016 to 18% between 2017 and 2019. The increase is likely driven by the need to compete for technology talent in a national market.

- The most valuable companies typically have lower equity compensation dilution levels at the time of their IPO.

- Companies with IPO market capitalization greater than $5 billion have median dilution of 14.8%, which is nearly 25% lower than those with market cap below $5 billion where the median is 19.1%.

- There is no clear correlation between company size and dilution levels at IPOs with market cap below $5 billion.

- Reduced sharing of equity capital at the largest companies is likely due to their more valuable and probably lower risk awards.

*Equity compensation dilution is calculated as the number of options and full-value shares outstanding immediately prior to the IPO divided by the fully-diluted shares outstanding prior to the IPO float.

Jin Fu

Jin Fu

Principal

Jin Fu consults across a diverse range of industries and stages of growth, from pre-IPO to S&P 500 companies. She has experience on all aspects of executive compensation strategy and design, including short- and long-term incentive plans, equity compensation, corporate governance, and corporate transactions, including preparation for initial public offerings.

Alec Lentz

Alec Lentz

Principal

Alec Lentz has vast executive and director compensation experience with companies of all industries and sizes, especially technology and life sciences, including for privately-held / venture-backed companies and recent IPOs. Alec believes that business strategy should inform compensation design and helps clients align pay with performance. He has written about pre-IPO compensation practices and director compensation, featured on the firm’s website.