Glass Lewis Pay-for-Performance Methodology Update for 2026

By David Yang, Managing Director

Share

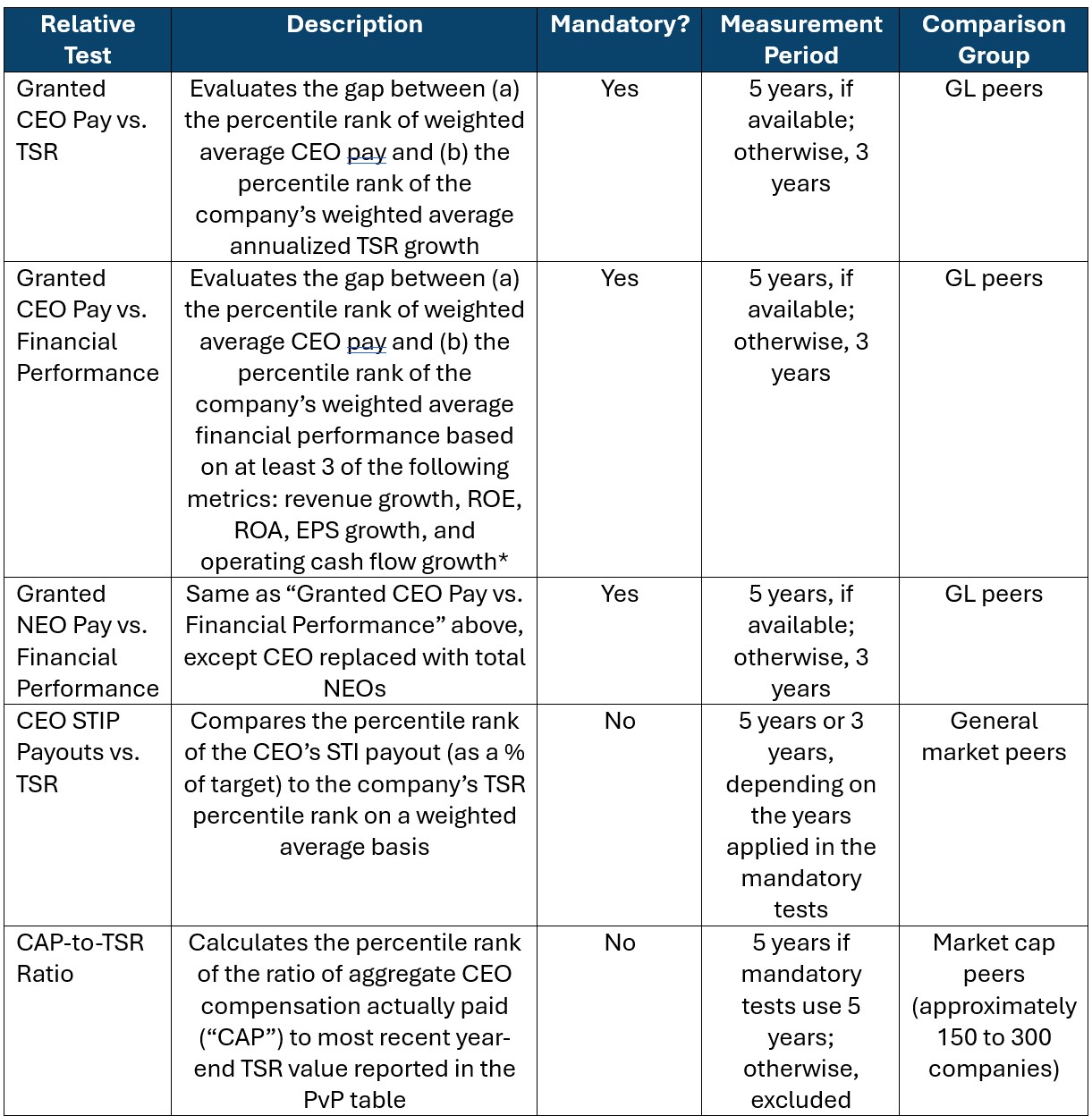

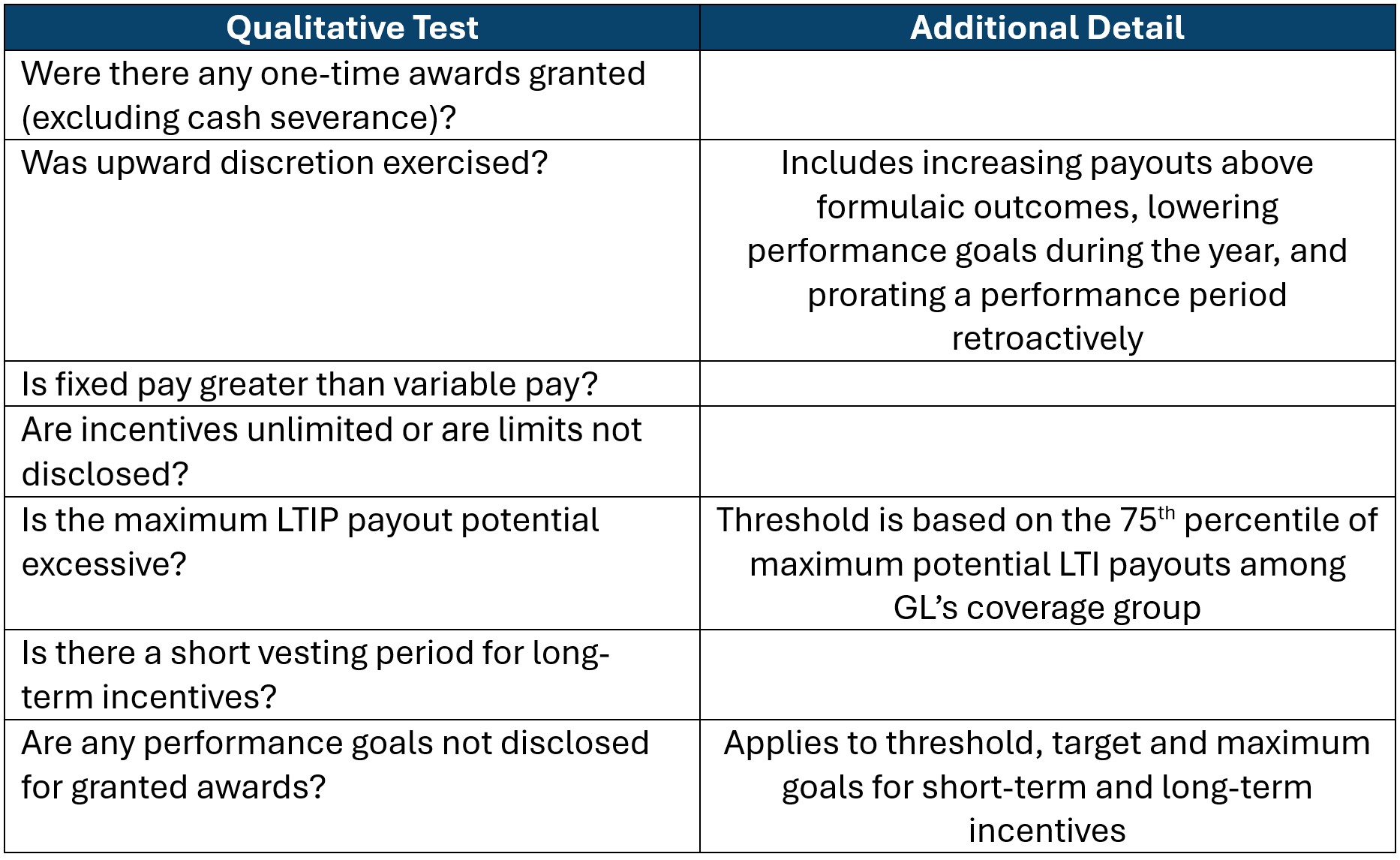

Glass Lewis (“GL”) recently announced major updates to its pay-for-performance (“P4P”) model for the 2026 proxy season. The P4P model serves as the foundation for GL’s evaluation of a company’s executive pay practices to inform its say-on-pay vote recommendation. The updated P4P model will be based on a new multi-test scorecard that consists of five relative tests and one qualitative test (i.e., six total). The relative and qualitative P4P tests for US companies are summarized below:

*For Banks/Financials/Mortgage REITs, tangible book value growth per share replaces operating cash flow growth; for most equity and specialized REITs, funds from operations growth replaces EPS growth

*For Banks/Financials/Mortgage REITs, tangible book value growth per share replaces operating cash flow growth; for most equity and specialized REITs, funds from operations growth replaces EPS growth

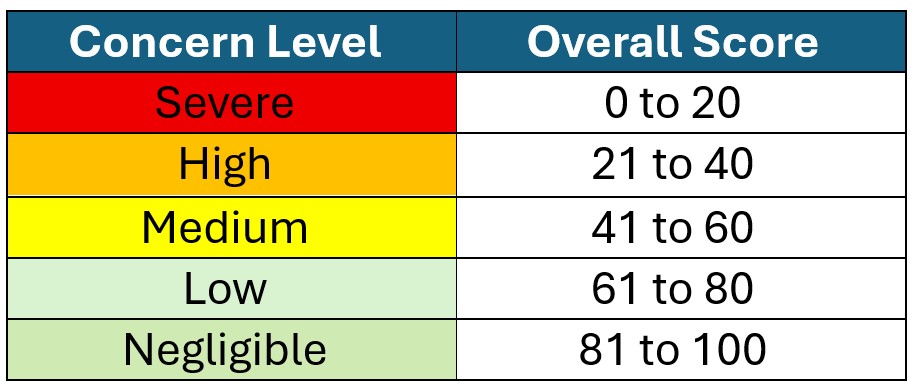

Each relative test contributes points to a numerical overall P4P alignment score that ranges from 0 to 100. The qualitative test serves as a negative modifier and can only reduce the overall P4P alignment score. The overall score translates to a level of P4P misalignment concern according to the following table:

The new P4P model reflects the following key changes from GL’s current P4P methodology:

- Replaces the current letter grading system (i.e., A to F) with a numerical scorecard

- Extends the pay-for-performance alignment measurement period from 3 years to 5 years

- Expands the relative pay and performance comparisons beyond the GL peer group to include broader general industry and market capitalization peers

- Utilizes multiple definitions of pay with the introduction of CAP to the model

The information provided above reflects our current understanding of the new P4P model, which is expected to be made available for access by GL in mid-October. We will update this summary as additional details of the new model are made available. In the meantime, additional information regarding the model updates can be found in this FAQ prepared by Glass Lewis and the accompanying videos here and here.

David Yang

David Yang

Managing Director

David Yang has advised numerous public and privately-held companies on all aspects of executive and board compensation. His experience covers a wide range of industries, including healthcare, financial services, retail, consumer products, transportation, and technology among others. He is a frequent speaker on executive compensation topics and a regular author of the firm’s alert letters.