Crypto Treasury Execs May Cash In as Stocks Soar, But Will Shareholders Be Cheated?

By Steven Ehrlich for Unchained with FW Cook Contribution By Metin Aksoy

Share

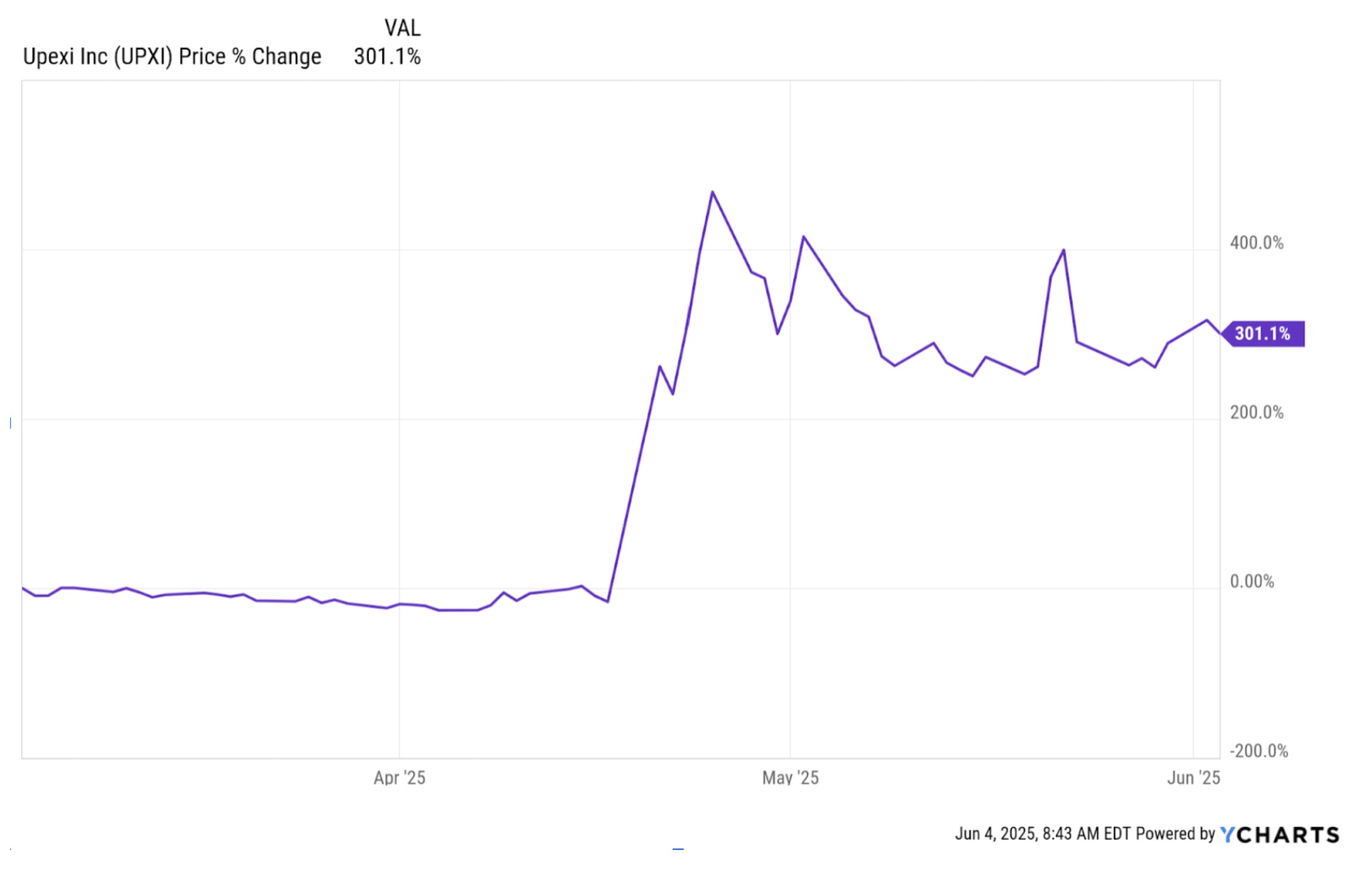

Upexi, a consumer products company offering medicinal mushrooms and caffeine alternatives, had been struggling for years. From the period of April 2020 to the beginning of April 2025, its stock fell 98.02%. But that all changed on April 21, when it announced the creation of a sol treasury strategy with an initial deployment of $100 million. Since that day the stock is up over 300%.

Prior shareholders and early adopters in this company are certainly reaping the benefits of this appreciation, but perhaps nobody is poised to benefit as much as its executives. The same is true for almost all companies riding crypto’s bubble. In fact, dozens of firms have transitioned to becoming crypto holding firms.

In the last few weeks alone, Twenty One, created by SoftBank and Tether, launched via a Cantor Fitzgerald SPAC with $685 million in capital to buy bitcoin. Nakamoto, founded by Bitcoin Magazine’s David Bailey, merged with a publicly traded medical firm, raising $710 million to buy bitcoin. And not to be outdone, Trump Media & Technology Group raised $2.44 billion last week for the same purpose.

Many of these companies are trading at massive premiums to the actual value of the crypto on their balance sheets. For instance, MetaPlanet is trading at a premium of 6.1x to its 8,888-bitcoin holdings, the recently announced Nakamoto at 58.1x to its 12-BTC stash, and Strategy (MSTR) at a 1.7 premium to its 580,280-BTC stockpile. And this without the executives creating much other economic value, at least not yet.

This frenzy raises the question of how these executives’ performance will be measured. One company is throwing out the traditional playbook in favor of a more innovative model that is less tethered to the stock price and more to the amount of crypto acquired.

But what would make the most sense? And what will investors feel is most fair?

Ripping Up the Traditional Playbook

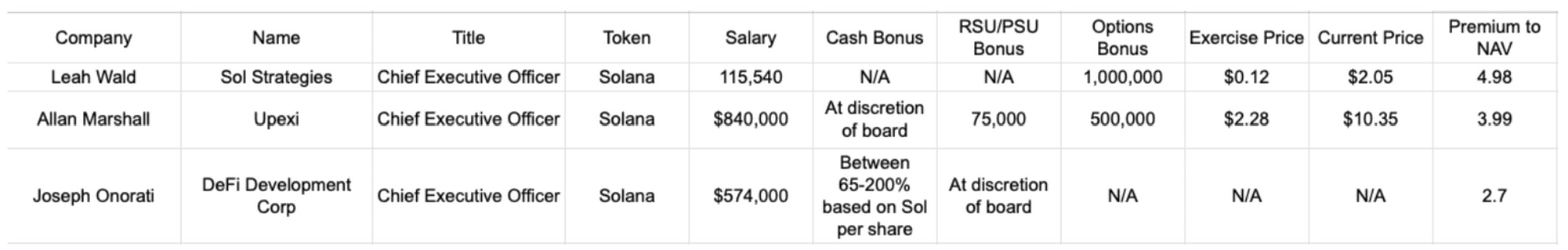

For a look at a more typical way of compensating executives, take Upexi. According to a company filing on April 24, just after the announcement of this new strategy, Upexi CEO Allan Marshall’s salary is $840,000. But he also gets a warrant to purchase 500,000 shares at a strike price of $2.28 over the next five years as well as a restricted stock grant of 75,000 shares that vest after just six months.

At the stock’s current price of $10.95, he is looking at a paper gain of $4.34 million from his options, assuming that the price does not drop. (It is worth noting that Upexi’s stock is down 29% since the initial surge ended on April 25, meaning that if investors did not get in before or right after the announcement, they are losing money.)

In contrast, on May 14, DeFi Development Corporation announced a plan to anchor the bonuses for its CEO, CFO, and CIO to the ratio of its solana stack in comparison to the amount of shares in circulation.

In contrast, on May 14, DeFi Development Corporation announced a plan to anchor the bonuses for its CEO, CFO, and CIO to the ratio of its solana stack in comparison to the amount of shares in circulation.

The company says that this better aligns the long-term incentives of both the company and shareholders.

“If a team is compensated on market cap or something not associated with necessarily the goals of the individual shareholder, you may have extreme dilution with no appreciation for shareholders, but the management team is making millions of dollars in compensation,” said DeFi Development Corporation Chief Financial Officer John Han in an interview. “That is not fair. We shouldn’t benefit from the solana price going up.”

Many other companies are also saying that they judge themselves by the ratio of their crypto per share. Twenty One CEO Jack Mallers said in a recent Bloomberg interview, “My job…is to grow our bitcoin per share.” Some investors, such as Pantera Capital, are looking at more dynamic metrics such as the growth rates of crypto per share. But, none of the high-profile companies mentioned above, including Twenty One and Nakamoto, have disclosed their executive compensation structures yet. So the investing public doesn’t know how their compensation will be calculated. DeFi Development Corporation is the only firm to put its money where its mouth is, at least publicly, for now.

Han and his team are betting that crypto treasury company investors will side with him. But is Solana per share or bitcoin per share the right metric to judge an executive team on? Experts in the field of executive compensation may disagree.

WAGMI Bonuses

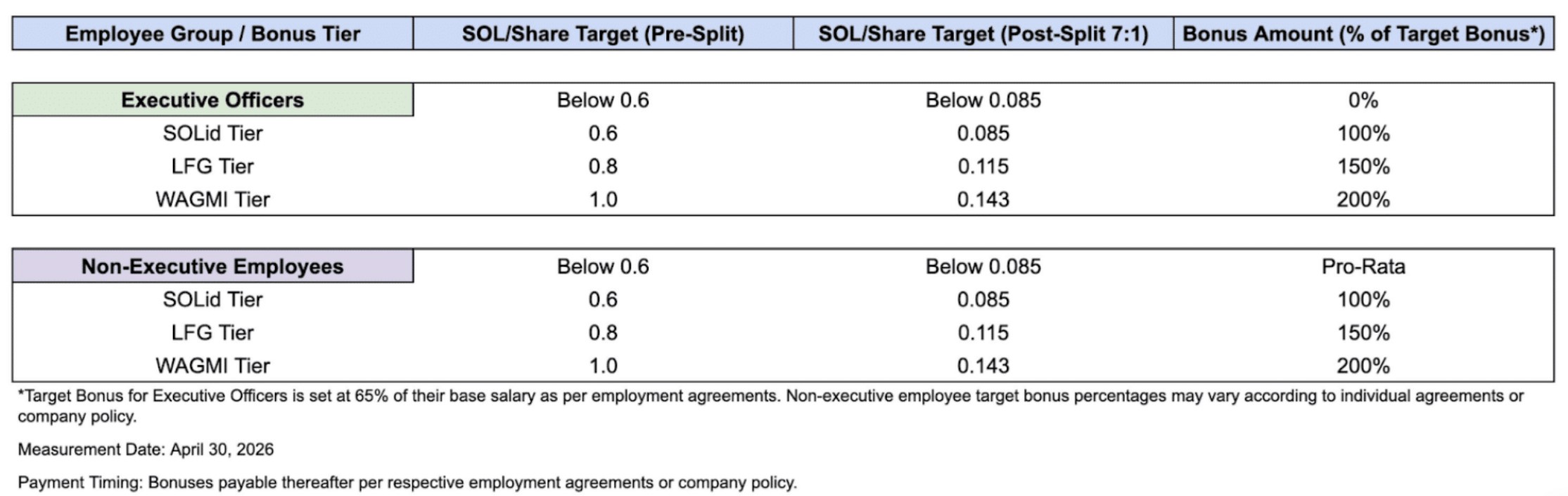

Since DeFi Development Corp is one of the only companies pursuing a newer exec compensation model to have a fully fleshed out plan, below is the table outlining its new bonus plan. If the company does not obtain at least 0.085 units of Solana per share by April 30, 2026, then the team gets no bonuses.

The current SOL/share number is 0.0422. To reach that minimum threshold for its SOLid tier, that number will have to more than double.

The target bonus for each executive is set at 65% of their annual base salaries. For CEO Joseph Onorati, who makes $574,000, that would equate to an additional $373,100. If he reaches the WAGMI Tier his bonus would climb to $746,200. These bonuses will be paid in cash, not stock. And Han says that the plan is to renew this program at term end with updated targets.

But even with these goals, Han says that the company is in uncharted territory. When asked how the company came up with these targets, he said, “To be honest, we didn’t really have much benchmarking.”

“But we saw where we were in life to date, since we only started this April, and we were about 0.295 kind of pre-[stock]split number and we’re like, ‘Okay, can we double this?’ And we said, ‘We feel good that we can aim to, and frankly if we don’t double it, we shouldn’t even get a bonus.’”

A Better Benchmark?

What is the best way to actually measure the competence of a management team in this new industry?

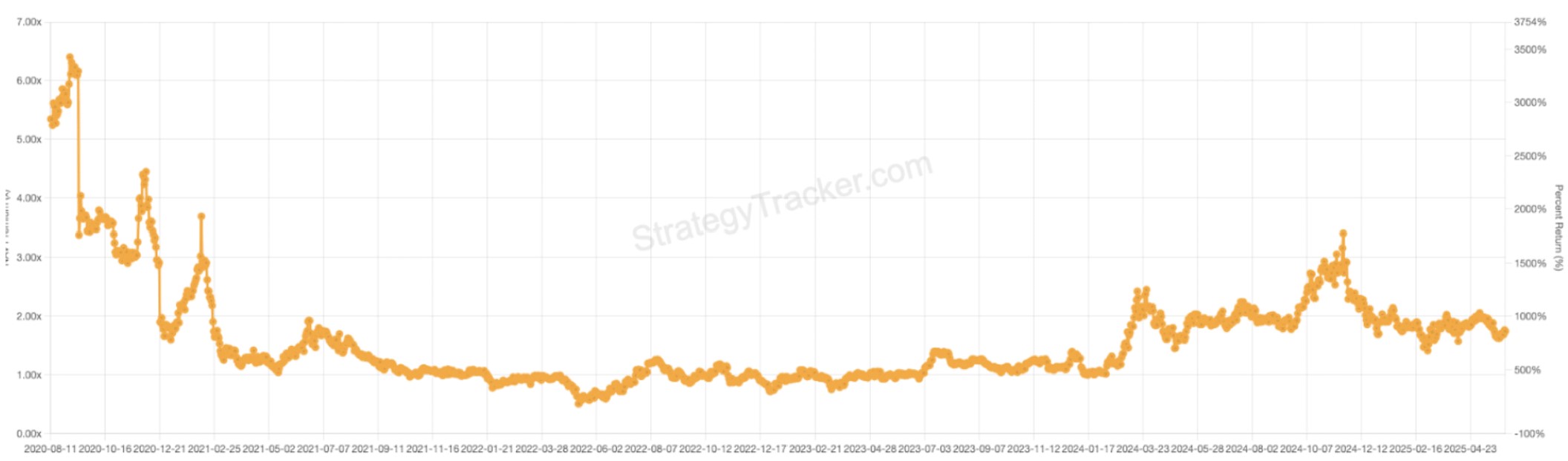

A strong argument could be made that companies should focus on the premium to NAV that companies achieve. While this may seem like the same thing as market capitalization or stock price, it isn’t. It seeks to measure the intrinsic value that the market places on a leadership team.

And in fact, this is not an uncommon metric used in traditional finance. “This is essentially looking at a financial metric known as premium over book, or the market premium over book value,” said Arthur Kohn, an expert in executive compensation and adjunct professor of law at New York University. “Lots of companies look at where they trade compared to book value and the financial industry in general. If you think that the company’s going to grow a lot, you give it a very high premium of market to book, if you think that it won’t or the management might waste the assets you might discount. I mean, those are the basics of it.”

As a potential benchmark, members of the KBW Banking Index, a broad-based cross-section of the banking industry, have an average price to book ratio of 1.44.

Here is a chart of the three primary Solana treasury companies, their CEOs compensation structures, and the current premium to NAV.

Ariel Zetlin-Jones, associate professor of economics at Carnegie Mellon University also agrees that premium to book value is an interesting benchmark, and it is rooted in a concept known as the informativeness principle. “What you want to do is use the signals that are most directly related only to the manager’s efforts at producing value for the company,” he told Unchained in an interview. “Implicitly it is a form of benchmarking, right? Because your bonus is not a function of the stock price performance, but it is a function of the premium on the shares relative to the coins you bought the same way Strategy trades above the value of its bitcoins, right?”

Even John Han agrees. “I think that’s very fair [to consider a premium to NAV]. I mean we should be doing better than an ETF and we should be doing better than an individual investor personally just buying Solana and staking it.”

The best example of a treasury company maintaining a premium is Strategy, formerly MicroStrategy, which has consistently maintained a premium above 2 for most of the year. This performance is particularly impressive given the competition that many observers expected for MSTR stock when bitcoin ETFs began trading in January 2024.

The Goldilocks Approach to Compensation

So what is the best way to structure compensation? There is no one-size-fits-all approach. “In a well-designed compensation program, you want to make sure it factors in short-term objectives and long-term strategic execution,” says Metin Aksoy, managing director at FW Cook, a global executive compensation advisory firm. “You want to tie a lot of it to the share price, but you want to avoid over-weighting it in the short term.”

He points out that a best practice would include two different incentive plans. The short-term one, which could be cash-based, would focus on business execution, “meaning, ‘What are we trying to accomplish to drive shareholder value creation in a sustained way over a long-term basis?’” This initial step would appear to dovetail well with DeFi Development Corporation’s new strategy focused on solana accumulation.

But then there is additional nuance that should also be factored into the equity component. In particular, shareholders should be concerned if most of the equity bonus is based on options because they could encourage excessive risk taking. “If you have a very, very high proportion of the potential pay being delivered in stock options, there is asymmetric risk associated with that, meaning very little downside because they have no intrinsic value yet,” says Aksoy.

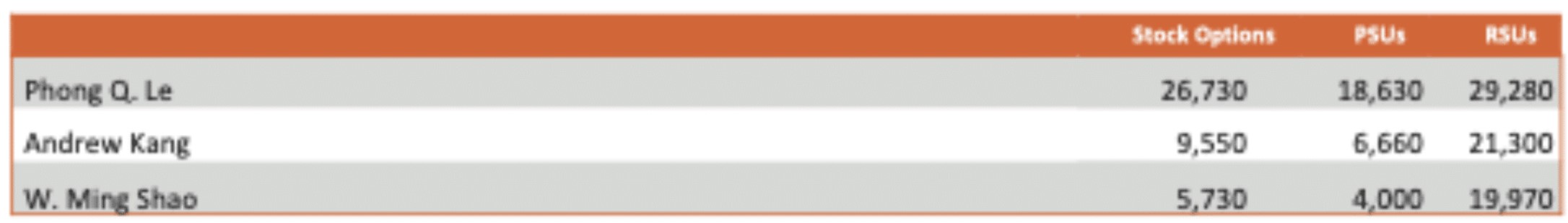

An interesting example of how this can be achieved among crypto treasury companies is looking at the compensation structure of Strategy CEO Phong Le. According to company filings in 2024, he received a salary of $1,000,000 and a cash bonus of $880,000. His equity payout was worth $13.38 million, but 25% of it was based on performance metrics (18,630 performance stock units, aka PSU). Even the 29,280 Restricted Stock Units (RSUs) encourage caution from Le since those are time-vested and granted at the current price. They can go down.

Going back to Upexi CEO Allan Marshall’s compensation, 87% of his equity bonus is based on options. His contract does say that he can hit additional (unmentioned) performance bonuses, but those are not tied to these option grants. Upexi did not respond to a request for comment.

Options have very little value until they go into the money. This is why they can be risky. “But the upside is huge if you create a ton of value,” says Aksoy. “You may be encouraged to shoot for the moon.”

Republished with permission. View the original publication here at Unchained.

Metin Aksoy

Metin Aksoy

Managing Director

Metin Aksoy has 20 years of consutling experinece. He works with clients across a wide range of industries and at various stages of the company life cycle. His clients range from large publicly traded organizations to smaller publicly traded or privately held companies, including a number of private equity portfolio companies.