The Executive Pay Dilemma

By Michael R. Marino, Arthur H. Kohn, Caroline F. Hayday

Share

Executive pay in the midst of the pandemic presents an obvious dilemma. On the one hand, it would be a stretch to blame fairly management teams for most of the adverse financial performance that will stretch across a broad range of industries. On the other, they cannot escape the consequences either.

Consider that while stock values may bounce back for many companies in the reasonably short term, it is unlikely that business will quickly return to the status quo ante. In some industries, the markets for products and services may change permanently; in other industries, supply chain and inventory management may also be permanently affected. Not least, rank and file employees and other stakeholders across the economy will suffer. Many executives will take short-term salary cuts in recognition of the hardship, but that is a preliminary and largely symbolic step and compensation committees need to find the right overall balance between reward and respect for the economic environment.

The situation requires unusual judgment by all involved. It presents novel choices involving health and economics, as much at the level of the individual firm as at the national and state levels. In particular, many of these choices highlight issues around “corporate purpose” and “stakeholder interests” – i.e., the idea that corporations may, at least at times, act with an eye towards broader interests than immediate stockholder value for various reasons. These can be hard and complicated choices, involving trade-offs between multiple desirable objectives, including managing revenue and expense, the provision of important economic services, community cohesion and employee and customer health, as well as in some cases political considerations.

While the pandemic will have an adverse impact on financial performance across a broad range of industries, the impact will not be uniform. Regardless of the magnitude of the impact, balancing executive and stakeholder interests should be a top priority for compensation committees in the months to come. Many compensation committees have begun considering these issues. Compensation committees are eager to assess program vulnerability and develop action plans. Philosophically, we think that a productive way for compensation committees to move forward and play an important role in the decisions to be made is to focus on corporate purpose and broad stakeholder interests.

Such a focus could incentivize executive teams to act in the crisis in a way that maintains and builds enterprise value. While executive compensation programs commonly measure the outcomes of performance, such as revenue growth, profitability, capital efficiency or total shareholder returns, now is the time to focus on the drivers of performance, specifically the factors tied to business health and sustainability. This would allow compensation committees to recognize and reward executives who outperform in the context of the very challenging financial and business environment. COVID-19 is a wake-up call that environmental/social issues can trigger huge financial risks and threaten company sustainability.

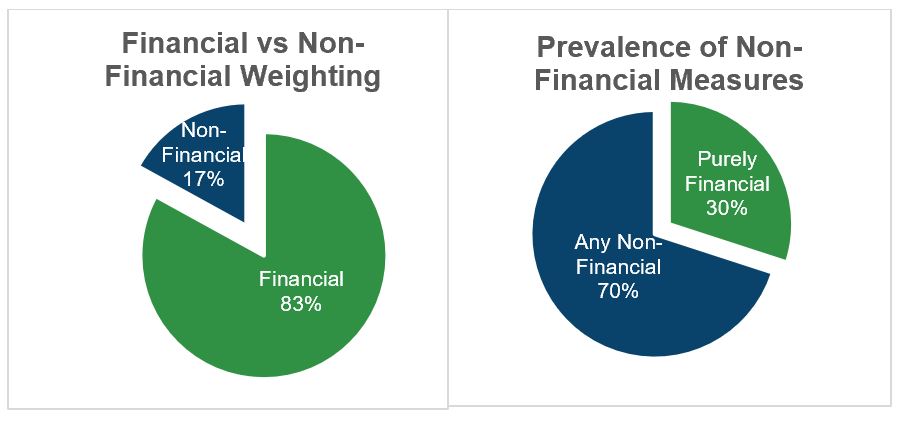

While some companies have over the past few years taken steps towards utilizing such metrics in incentive plans, a more pronounced shift in focus away from typical financial performance metrics to the underlying drivers of performance, which may be less tangible but still objectively measurable, may be appropriate in the environment as a temporary measure. As indicated in the following charts, the prevalence of non-financial measures is fairly common, but the allocation of incentives tied to those types of metrics has been modest.

Chart 1. FW Cook – Annual Incentive Design Research, 2019 Top 250 Report

At the end of this note, we suggest a novel approach to incorporating these long-term value drivers into a decision that some compensation committees will need to consider in the current environment: repricing stock options. This approach should make it easier to manage executive pay decisions, and long-term shareholders should applaud the focus.

There is no one-size-fits-all approach, but what we have in mind more specifically can be broken down as follows:

Salary Reductions

Many of the hardest-hit companies are starting to implement executive salary reductions, typically through year-end 2020. At most companies, those reductions are not impacting other elements of the pay package, such as annual bonuses, long-term incentives, or severance or other fringe benefits. We expect that these salary reductions will not be extended or made up in subsequent periods. Their limited nature serves as a useful first step, but should not require hard compensation committee decisions at most companies.

2020 Annual Incentive Programs

The consistent use of historical performance metrics for 2020 annual incentive plans, notwithstanding the pandemic, likely does not make sense at most companies. Goals set pre-crisis may be impossible to achieve, thereby eliminating the incentive power of the program. Maintaining the right balance between the shareholder experience, motivational value of incentives, and accountability will be difficult.

Most companies are considering the typical actions in response to market turbulence, including (1) adjusting the incentive curve (i.e., increase the maximum performance level and decrease the threshold performance level without changing the targets goals), (2) truncating the above-target payout (e.g., stretch the payout range above target to max out at 150%) rather than setting higher above-target goals for the current 200% maximum payout, (3) introducing a stub-year, reduced payout opportunity bonus program based on revised goals, (4) adjusting goals but capping payouts at 100% (or less) of target, (5) continuing to monitor results and impact, but taking no specific actions at this time, and (6) agreeing to re-assess and evaluate performance after year-end.

While this approach seems sensible, the uncertainty of the environment, stemming from a global health crisis with no clear end, makes implementing thoughtful changes for the remainder of the year difficult. Consider instead setting new, additional short-term non-financial goals, including some relating to COVID-19 response and recovery targets.

The following are examples of non-financial and financial performance metrics that could be considered for the short term.

- Workforce sustainability. Maintaining private sector employment levels has been an important element of government policy in the crisis. Many companies have made difficult decisions in that regard, in the interest not just of public policy objectives but also because workforce continuity at all levels benefits the business. Management teams that have taken pains to maintain payroll levels should be rewarded.

- Voluntary Separation Programs. Many companies are implementing voluntary separation programs in lieu of layoffs, potentially with enhanced levels of benefits compared to historical and market practice. These incentives can be costly relative to layoffs, but they can also enhance employee morale and build community goodwill. Management teams that prudently use voluntary programs should be given credit for the positive intangible impacts of that approach.

- Employee and Customer Safety. Following social distancing guidelines is inconsistent with the normal operation of many businesses. Executive teams that have made difficult decisions about closing operations should be recognized. Those decisions may have adverse short-term financial impacts, but long-term reputational benefits. Similarly, companies that have creatively managed their operations in order to minimize health and safety risks to the workforce should be rewarded for those efforts. Such measures include not just work-at-home arrangements, but also implementing new sick leave guidelines, use and provision of personal protective equipment, revising work-shift arrangements and accommodating family leave needs for COVID-19 caregivers.

- Capital Structures and Liquidity. As Warren Buffett famously said, “Only when the tide goes out do you discover who's been swimming naked.” The tide is out for many companies. Some of them managed their capital structures and cash resources prudently over the last few years, and others less so. Those executive teams that have done a good job, as evidenced by the lack of a need to take extraordinary measures in the midst of a crisis, should be rewarded.

Multi-Year Cash and Equity Incentive Programs

In addition to 2020 annual incentives, 2020 performance is likely to impact materially the vesting of multi-year cash and equity performance programs.

For programs that were scheduled to end in 2020, companies will have two or more years of performance already registered but 2020 performance could undercut payout expectations. If the economic rebound proves robust but does not arrive until 2021, that consequence could reasonably be viewed as unfair, particularly for companies that planned well for the crisis and managed well in it and particularly for less senior members of the management team. The question will arise as to whether adjustments can and should be made to metrics to reflect the changed environment.

Also consider that shareholder safeguards that limit performance share payouts to 100% of target if stock price or TSR is negative for the performance period could be triggered. These provisions were encouraged by the proxy advisors and are relatively prevalent. The possibility of applying the limitation was regarded as remote in the bull market but could now be common, especially for three-year performance periods ending with fiscal year 2020. Consideration also could be given to extending performance periods - e.g., adding an additional performance year in order to reflect the rebound in the payout calculations, subject to contractual and technical tax issues that may limit a company’s ability to do so without significant adverse consequences. Some companies may address these issues in their next grant cycles with retention or outperformance grants.

For other long-term plans, compensation committees should consider adjustments that preserve the incentive intent of the original program. Those could include (1) de-emphasizing 2020 results and extending performance periods to restore the original performance measurement period, (2) modifying performance ranges for outstanding awards (i.e., adjusting the payout curve), (3) adjusting the mix of performance-based vs. time-based vesting in long term incentives, (4) introducing relative performance metrics for new awards, and (5) adding relative TSR as a modifier to outstanding grants or incorporating the modifier into design for new awards. Alternatively, metrics could be adjusted as suggested above to reflect long-term non-financial drivers of value creation, subject to technical accounting issues.

Repricing Stock Options

Repricing stock options has been a controversial practice for many years. Shareholder approval is generally required pursuant to exchange listing rules and incentive plan provisions. The proxy advisors have imposed their own requirements for a favorable recommendation, including waiting one year from a precipitous market drop before repricings are implemented.

While concerns about option repricings are well-founded, we believe that reliance on the historical approach for assessing when repricings should be approved misses an opportunity, particularly where there are significant stock option holdings that are nearing the end of their term. ISS, for example, recently announced that they will continue to assess option repricing proposals under their existing guidelines, generally recommending against any repricing that occurs within one year of a precipitous drop in a company’s stock price. Putting aside the waiting period, ISS relies on a case-by-case approach that takes into account, among other factors, whether (1) the design is shareholder value neutral (i.e., a value-for-value exchange base on a black-scholes or similar financial valuation analysis), (2) surrendered options are not added back to the plan reserve, (3) replacement awards do not vest immediately, and (4) executive officers and directors are excluded.

In our view, there is certainly merit to the approach of not acting hastily, before compensation committees get a better view of the impact of the crisis on their stock values. For most companies, shareholder approval will not occur until the next regularly-scheduled meeting of shareholders in the spring of 2021, so there is time to think about the appropriate approach. We suggest that the situation gives companies a unique opportunity to focus on long-term sustainability, by incorporating objective, measurable sustainability metrics as vesting conditions for the repriced options. That approach properly aligns the interests of long-term shareholders with executives in respect of these very long-term awards. It also brings practical focus to recent efforts to highlight sustainability and corporate purpose. We believe that repricings that creatively incorporate substantial sustainability metrics can and should gain the support of shareholders, including for programs that cover senior members of management teams.

Michael R. Marino is Managing Director and Head of the New York office of FW Cook. Arthur H. Kohn is a partner, and Caroline F. Hayday is counsel, in the Executive Compensation and ERISA group in the New York office of Cleary Gottlieb.